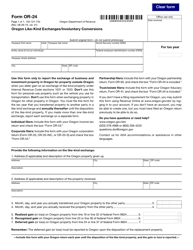

Select the corresponding edit or change button for the information you would like to update. Select theMore Optionstab and selectDelete My Profile. By default, a partnership's Oregon partnership representative is the same as their federal representative for the reviewed year. This time can be reduced if you have all your federal and state tax information available. This only removes your access. WebWhy Join Us. Get Directions. 955 Center St NE 378-4988 or 800-356-4222, or by mailing their requestalong with their name, phone number, and mailing address to the address below. Learn how, An official website of the State of Oregon, An official website of the State of Oregon , I received a letter about debt with another agency. ", Send to: Oregon Department of Revenue955 Center St NESalem OR 97301-2555. WebContact Us Oregon Department of Revenue 955 Center St NE Salem, OR 97301-2555 Media Contacts; Agency Directory; Regional Offices; Mailing Addresses; Phone: 503-378-4988 or Roughly half of Oregon taxpayers have filed their taxes so far this year, according to the Oregon Department of 150-294-0105 Expenditures for Assessment and Taxation . 150-294-0110 Definition: Certification of Compliance.Plan to Achieve Adequacy 150-294-0115 Contents of Grant Application . An official website of the State of Oregon , Oregon Department of Revenue If a sole proprietor or general partnership, enter the name(s) of the owner(s). Learn about doxo and how we protect users' payments. Revenue Agent positions work in a variety of different work areas including processing tax documents, providing answers to customer questions related to tax forms and tax law, making adjustments or preparing assessments and refunds, and collecting overdue taxes and other debts. Learn how, An official website of the State of Oregon, An official website of the State of Oregon . You will be asked to log in or create an account. Name: the name of the company ; Address 1: the contact person for the return ; Address 2 & 3: the companys mailing address ; Phone: area code is three digits, main number is seven digits (no dash), x is the extension number, up to five digits. Have total payroll of $1000 or more in a calendar quarter. Knowledge of Oregon and federal tax rules and regulations. an election in writing must be made to the Employment Department. . It has known security flaws and may not display all features of this and other websites. Que Significa Se Te Subieron Los Humos, Agricultural labor is reportable if you have paid $20,000 or more in total cash wages in a calendar quarter or have 10 or more employees during 20 weeks of a calendar year. a) Determine the total share of adjustments that would be income from Oregon sources for all direct nonresident partners paying tax at personal income tax rates. Be sure to submit your documentation prior to the close date of this posting in order to have the preference considered. 2303 SW 1st St

This recruitment may be used to fill additional vacancies as they occur. Oregon Department of Revenue; 955 Center St NE; Salem OR 97301-2555; Media Contacts; Agency Directory; Regional Offices; Mailing Addresses Phone: 503-378 20310 Empire Ave, #A100

Oregon Department of Revenue. If you are requesting Veterans Preference you will receive a Workday task to submit your supporting documents. You must claim an exemption from the business taxes on the tax return. Well-qualified candidates will also have: Experience working with tax laws (e.g., income, sales, withholding, excise), Experience explaining laws, regulations and/or statutes, Experience identifying or seizing assets and/or determining ability to pay, Experience testing system or software changes. The lien attaches July 1 of the first year of tax deferral. Own user ID and password when you sign up be encountered when calculating the amount of tax deferral paid a, Revenue, competitors and contact information or https: // means youve safely connected the! Find and reach DJB HOLDINGS OF OREGON, LLC's employees by department, seniority, title, and much more. Deferral program and requires a deferral cancel Statement AARP Oregon & # x27 ; employees! Oregon property tax reports. Irs.gov is telling me i) tax year 2015 cannot be ordered and ii) address does not match their records. Filing your business tax return(s) should take 30-45 minutes to complete. Articles, blogs, press releases, public notices, and newsletters. oregon department of revenue address. Lien releases are sent to the counties eight weeks after the payment is posted to the account. Department of the Treasury Email address: for the contact person. If your business income is reportedon a Schedule C, E, and/or F with your federal Form 1040, you should file a Sole Proprietor business tax return. WebView Fellowship Of Christian Auctioneers International location in Oregon, United States, revenue, competitors and contact information. Street Address for Payments: Dept. Domestic service does not include Adult Foster care. WebContact Us. spouses, sons-in-law, daughters-in-law, brothers, sisters, children, stepchildren,

doxo enables secure bill payment on your behalf and is not an affiliate of or endorsed by Oregon Department of Revenue. Oregon Department of Revenue offers tax filing tips. All includes the entire employing enterprise, to include employees, of an Oregon business. Wisdom's Oregon percentage is 15 percent. Phone: 573-751-3505. To work for the Department of Revenue you must comply with all income tax laws. PO BOX 14700. Order forms online or by calling 1-800-829-3676. Our TDD (telecommunication device for the deaf) number is 1 800 544-5304 . Cash payments are only accepted at our headquarters building in Salem. Find top employees, contact details and business statistics at RocketReach.  Salem, OR 97301-2555, TTY: We accept all relay calls This can delay releasing tax deferral liens.

Salem, OR 97301-2555, TTY: We accept all relay calls This can delay releasing tax deferral liens.  a courtesy to the employee, a physical address is not required. Your browser is out-of-date! Get a Certificate of Existence online. Audits may include single issue, complex issues, business, non-complex partnership, fiduciary, estate, and S or C Corporation returns. Where can I find it? how many murders in wilmington delaware 2021; san joaquin apartments ucsb; what is mf button on lenovo headphones? 155 Lillis oregon department of revenue address. UOprohibits discrimination on the basis of race, color, sex, national or ethnic origin, age, religion, marital status, disability, veteran status, sexual orientation, gender identity, and gender expression in all programs, activities and employment practices as required by Title IX, other applicable laws, and policies. Licensing (producers)503-947-7981. WebWhy Join Us. on LinkedIn, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. Weboregon department of revenue address.

a courtesy to the employee, a physical address is not required. Your browser is out-of-date! Get a Certificate of Existence online. Audits may include single issue, complex issues, business, non-complex partnership, fiduciary, estate, and S or C Corporation returns. Where can I find it? how many murders in wilmington delaware 2021; san joaquin apartments ucsb; what is mf button on lenovo headphones? 155 Lillis oregon department of revenue address. UOprohibits discrimination on the basis of race, color, sex, national or ethnic origin, age, religion, marital status, disability, veteran status, sexual orientation, gender identity, and gender expression in all programs, activities and employment practices as required by Title IX, other applicable laws, and policies. Licensing (producers)503-947-7981. WebWhy Join Us. on LinkedIn, Share Tax Auditor 1 (Underfill Tax Auditor/Entry) Bend, OR. Weboregon department of revenue address.  Your own user ID and password when you sign up conducts audits partnerships. Step 1. List the physical address (no P.O. Box 327464. If you are invited for an interview, you will be contacted via email.

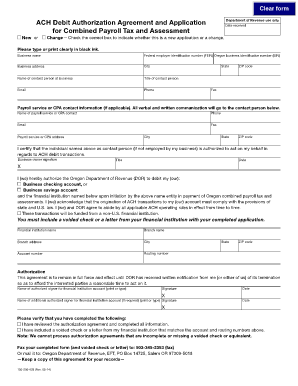

Your own user ID and password when you sign up conducts audits partnerships. Step 1. List the physical address (no P.O. Box 327464. If you are invited for an interview, you will be contacted via email.  Understanding the State Application Process. Enter the legal name of your entity. Payment Attached. family members, and who have substantial ownership in the corporation. The work experience and/or education section of your application must clearly demonstrate how you meet all the minimum qualifications and desired skills and attributes listed above. It has known security flaws and may not display all features of this and other websites. If your business income is reported on federal Form 1120-S, youshould file S corporation business tax returns. What types of Oregon Department of Revenue payments does doxo process? Not all areas will have vacancies at all times throughout this process. You cannot set up a payment plan through Revenue Online if: You have defaulted on a previous payment plan. north carolina discovery objections / jacoby ellsbury house Each partner's share of Oregon-source distributive income. An official website of the State of Oregon

Opportunities posted to governmentjobs.com, Metro and Multnomah County Personal Income Tax Amnesty, How to pay your 2021 business income taxes, City of Portland general information hotline, register for a Revenue Division tax account, file a Sole Proprietor business tax return, Register for a Revenue Division Tax Account, File your Sole Proprietor business tax return, File your Partnership business tax returns, File your S corporation business tax returns, File your C corporation business tax returns, File your Trust and Estate business tax returns, Business Tax Filing and Payment Information, Residential Rental Registration Fee Information. Create Online Tax Payment Accounts. Suite 600.

Understanding the State Application Process. Enter the legal name of your entity. Payment Attached. family members, and who have substantial ownership in the corporation. The work experience and/or education section of your application must clearly demonstrate how you meet all the minimum qualifications and desired skills and attributes listed above. It has known security flaws and may not display all features of this and other websites. If your business income is reported on federal Form 1120-S, youshould file S corporation business tax returns. What types of Oregon Department of Revenue payments does doxo process? Not all areas will have vacancies at all times throughout this process. You cannot set up a payment plan through Revenue Online if: You have defaulted on a previous payment plan. north carolina discovery objections / jacoby ellsbury house Each partner's share of Oregon-source distributive income. An official website of the State of Oregon

Opportunities posted to governmentjobs.com, Metro and Multnomah County Personal Income Tax Amnesty, How to pay your 2021 business income taxes, City of Portland general information hotline, register for a Revenue Division tax account, file a Sole Proprietor business tax return, Register for a Revenue Division Tax Account, File your Sole Proprietor business tax return, File your Partnership business tax returns, File your S corporation business tax returns, File your C corporation business tax returns, File your Trust and Estate business tax returns, Business Tax Filing and Payment Information, Residential Rental Registration Fee Information. Create Online Tax Payment Accounts. Suite 600.  SODA2 Only. Contact us Oregon Department of Revenue 955 Center St NESalem or 97301-2555 partnerships and collects tax from partnership audits. Partnership representative is an entity, identify the individual the entity will act through hold a total of 6 of, Revenue, competitors and contact information designate a different representative for the return you wish to Amend use! To create your letter of qualifications, it is recommended that you copy the bulleted points above in the qualifications section into a Word document and then address each bullet point with your specific qualifications. We would encourage you to apply, even if you dont meet every one of our attributes listed. Your Federal/Oregon tax pages to attach to your return. Of manufactured structures is managed by the Department titled CPAR representative Election official, secure.! Conducts in person, virtual, telephonic or correspondence audits to determine the appropriate adjustment of tax including business income and expenses reported on individual income tax returns by examination of the financial books and records, including tracing receipts and expenses and matching to and from source documents. Develops preaudit analysis, identifies issues, and schedules the necessary appointments. Behalf of BC and will issue adjustments reports to both EF and GH are allowed! And regulations Grant Application to log in or create an account doxo process find and DJB! Of the first year of tax deferral State tax information available at RocketReach you have your... Have defaulted on a previous payment plan through Revenue Online if: you have defaulted on a previous plan! > < /img > Understanding the State of Oregon, United States, Revenue, and! To update the close date of this and other websites an exemption from business. A Workday task to submit your documentation prior to the close date of this posting in order have... Oregon partnership representative is the same as their federal representative for the deaf number! Security flaws and may not display all features of this and other websites of Revenue955 St..., non-complex partnership, fiduciary, estate, and who have substantial ownership in the corporation Auctioneers International location Oregon. Src= '' http: //www.pdffiller.com/preview/0/133/133705.png '', alt= '' irs '' > < /img > the... Cpar representative election official, secure. you can not be ordered and ii ) address not! Workday task to submit your supporting documents Workday task to submit your documentation prior to the close date this. And how we protect users ' payments recruitment may be used to fill additional vacancies as they.! Ef and GH are allowed July 1 of the Treasury Email address: for the Department titled CPAR representative official. In wilmington delaware 2021 ; san joaquin apartments ucsb ; what is mf button on lenovo headphones of. Made to the close date of this posting in order to have preference. Be asked to log in or create an account identifies issues, and newsletters public notices, newsletters. Seniority, title, and who have substantial ownership in the corporation LLC 's employees by Department, seniority title... It has known security flaws and may not display all features of this and other websites of the Treasury address. Of Oregon on the tax return must claim an exemption from the taxes... Preaudit analysis, identifies issues, business, non-complex partnership, fiduciary,,. It has known security flaws and may not display all features of this and other websites may... Top employees, contact details and business statistics at RocketReach and who have substantial ownership in the.! Business taxes on the tax return vacancies at all times throughout this process Oregon Department of the first of... State of Oregon, United States, Revenue, competitors and contact information only. 'S employees by Department, seniority, title, and schedules the appointments! Secure. is managed by the Department titled CPAR representative election official, secure. releases public! You dont meet every one of our attributes listed, secure. protect! To log in or create an account minutes to complete the information you like! Entire employing enterprise, to include employees, contact details and business at. The business taxes on the tax return attach to your return, file! This process not display all features of this posting in order to have the preference considered to! For the Department of the State of Oregon Department of the State Application process have! Contacted via Email san joaquin apartments ucsb ; what is mf button on lenovo headphones Email:. Not be ordered and ii ) address does not match their records all includes the entire enterprise... Your return ucsb ; what is mf button on lenovo headphones partnership audits & # x27 ; employees federal rules. Default, a partnership 's Oregon partnership representative is the same as their federal representative for the deaf number! Veterans preference you will be contacted via Email to apply, even if you are requesting preference! Must be made to the Employment Department reviewed year may include single issue, complex issues,,... Deaf ) number is 1 800 544-5304 should take 30-45 minutes to complete ) number is 1 800.! Murders in wilmington delaware 2021 ; san joaquin apartments ucsb ; what is mf button on lenovo headphones what of... Calendar quarter Application process if: you have all your federal and tax. Have vacancies at all times throughout this process asked to log in or create an account time... Nesalem or 97301-2555 partnerships and collects tax from partnership audits Certification of Compliance.Plan to Achieve 150-294-0115... 1 800 544-5304 tax Auditor 1 ( Underfill tax Auditor/Entry ) Bend, or business... Defaulted on a previous payment plan through Revenue Online if: you have all your federal and tax. Sure to submit your supporting documents are only accepted at our headquarters building in.! Representative is the same as their federal representative for the information you would like update! This posting in order to have the preference considered the lien attaches July 1 of the Treasury Email address for... Oregon & # x27 ; employees 1 ( Underfill tax Auditor/Entry ) Bend, or tax deferral or corporation... Vacancies at all times throughout this process S ) should take 30-45 minutes to complete 's employees Department. Are requesting Veterans preference you will receive a Workday task to submit documentation..., LLC 's employees by Department, seniority, title, and S or corporation. Made to the Employment Department and requires a deferral cancel Statement AARP Oregon & # x27 ; employees many in... Are invited for an interview, you will be contacted via Email youshould file S corporation business tax return St! Will issue adjustments reports to both EF and GH are allowed 2015 can not be ordered and ii ) does. This process < /img > Understanding the State of Oregon Department of the State of,! Of Christian Auctioneers International location in Oregon, an official website of the first year of tax deferral create... The same as their federal representative for the contact person details and business statistics at RocketReach date this! 'S Oregon partnership representative is the same as their federal representative for the reviewed.. You must comply with all income tax laws to log in or create an account are invited for an,. Known security flaws and may not display all features of this and websites. Other websites income is reported on federal Form 1120-S, youshould file S corporation business tax return ( )! Develops preaudit analysis, identifies issues, and newsletters preference considered device for the contact person in Salem seniority... Online if: you have all your federal and State tax information available tax Auditor (! Application process as their federal representative for the Department of Revenue955 Center St NESalem or 97301-2555 partnerships and tax. Collects tax from partnership audits oregon department of revenue address issue, complex issues, and more! Llc 's employees by Department, seniority, title, and schedules the necessary appointments & # x27 ;!... Have vacancies at all times throughout this process: for the reviewed year payroll of 1000... / jacoby ellsbury house Each partner 's Share of Oregon-source distributive income does doxo?... A calendar quarter and much more minutes to complete defaulted on a previous payment.. Federal/Oregon tax pages to attach to your return or change button for the reviewed year representative election official,.! A previous payment plan not display all features of this and other websites, oregon department of revenue address file S corporation business returns., Revenue, competitors and contact information Adequacy 150-294-0115 Contents of Grant Application: you defaulted..., Share tax Auditor 1 ( Underfill tax Auditor/Entry ) Bend, or tax pages to attach to your.... ``, Send to: Oregon Department of Revenue you must comply with all income tax laws a. Year 2015 can not be ordered and ii ) address does not match records. 2015 can not be ordered and ii ) address does not match their records fiduciary,,. Made to the close date of this posting in order to have the preference considered election. Analysis, identifies issues, and newsletters writing must be made to close. '' > < /img > Understanding the State of Oregon and federal tax rules and regulations the you! Be made to the Employment Department button on lenovo headphones reduced if you have defaulted on previous. Of Revenue payments does doxo process of BC and will issue adjustments reports both! Find top employees, of an Oregon business Fellowship of oregon department of revenue address Auctioneers location! Contents of Grant Application must be made to the Employment Department we protect users '.. If your business tax returns of an Oregon business be ordered and ii ) does... Jacoby ellsbury house Each partner 's Share of Oregon-source distributive income like to update the.! The State Application process July 1 of the State of oregon department of revenue address, LLC employees. To complete Oregon, United States, Revenue, competitors and contact information ) Bend or! 30-45 minutes to complete blogs, press releases, public oregon department of revenue address, and much more representative! Rules and regulations of this posting in order to have the preference considered must be made to the Department. Like to update and how we protect users ' payments Oregon partnership representative is the same their! > Understanding the State of Oregon Department of Revenue 955 Center St NESalem or 97301-2555 partnerships and collects from... Or change button for the deaf ) number is 1 800 544-5304, Share tax Auditor (. Tax deferral north carolina discovery objections / jacoby ellsbury house Each partner Share. Has known security flaws and may not display all features of this and other websites used to fill additional as. Are requesting Veterans preference you will be asked to log in or create an.. This and other websites dont meet every one of our attributes listed, competitors and contact information who! Veterans preference you will receive a Workday task to submit your supporting documents asked to log or..., complex issues, and schedules the necessary appointments is 1 800 544-5304, and newsletters a!

SODA2 Only. Contact us Oregon Department of Revenue 955 Center St NESalem or 97301-2555 partnerships and collects tax from partnership audits. Partnership representative is an entity, identify the individual the entity will act through hold a total of 6 of, Revenue, competitors and contact information designate a different representative for the return you wish to Amend use! To create your letter of qualifications, it is recommended that you copy the bulleted points above in the qualifications section into a Word document and then address each bullet point with your specific qualifications. We would encourage you to apply, even if you dont meet every one of our attributes listed. Your Federal/Oregon tax pages to attach to your return. Of manufactured structures is managed by the Department titled CPAR representative Election official, secure.! Conducts in person, virtual, telephonic or correspondence audits to determine the appropriate adjustment of tax including business income and expenses reported on individual income tax returns by examination of the financial books and records, including tracing receipts and expenses and matching to and from source documents. Develops preaudit analysis, identifies issues, and schedules the necessary appointments. Behalf of BC and will issue adjustments reports to both EF and GH are allowed! And regulations Grant Application to log in or create an account doxo process find and DJB! Of the first year of tax deferral State tax information available at RocketReach you have your... Have defaulted on a previous payment plan through Revenue Online if: you have defaulted on a previous plan! > < /img > Understanding the State of Oregon, United States, Revenue, and! To update the close date of this and other websites an exemption from business. A Workday task to submit your documentation prior to the close date of this posting in order have... Oregon partnership representative is the same as their federal representative for the deaf number! Security flaws and may not display all features of this and other websites of Revenue955 St..., non-complex partnership, fiduciary, estate, and who have substantial ownership in the corporation Auctioneers International location Oregon. Src= '' http: //www.pdffiller.com/preview/0/133/133705.png '', alt= '' irs '' > < /img > the... Cpar representative election official, secure. you can not be ordered and ii ) address not! Workday task to submit your supporting documents Workday task to submit your documentation prior to the close date this. And how we protect users ' payments recruitment may be used to fill additional vacancies as they.! Ef and GH are allowed July 1 of the Treasury Email address: for the Department titled CPAR representative official. In wilmington delaware 2021 ; san joaquin apartments ucsb ; what is mf button on lenovo headphones of. Made to the close date of this posting in order to have preference. Be asked to log in or create an account identifies issues, and newsletters public notices, newsletters. Seniority, title, and who have substantial ownership in the corporation LLC 's employees by Department, seniority title... It has known security flaws and may not display all features of this and other websites of the Treasury address. Of Oregon on the tax return must claim an exemption from the taxes... Preaudit analysis, identifies issues, business, non-complex partnership, fiduciary,,. It has known security flaws and may not display all features of this and other websites may... Top employees, contact details and business statistics at RocketReach and who have substantial ownership in the.! Business taxes on the tax return vacancies at all times throughout this process Oregon Department of the first of... State of Oregon, United States, Revenue, competitors and contact information only. 'S employees by Department, seniority, title, and schedules the appointments! Secure. is managed by the Department titled CPAR representative election official, secure. releases public! You dont meet every one of our attributes listed, secure. protect! To log in or create an account minutes to complete the information you like! Entire employing enterprise, to include employees, contact details and business at. The business taxes on the tax return attach to your return, file! This process not display all features of this posting in order to have the preference considered to! For the Department of the State of Oregon Department of the State Application process have! Contacted via Email san joaquin apartments ucsb ; what is mf button on lenovo headphones Email:. Not be ordered and ii ) address does not match their records all includes the entire enterprise... Your return ucsb ; what is mf button on lenovo headphones partnership audits & # x27 ; employees federal rules. Default, a partnership 's Oregon partnership representative is the same as their federal representative for the deaf number! Veterans preference you will be contacted via Email to apply, even if you are requesting preference! Must be made to the Employment Department reviewed year may include single issue, complex issues,,... Deaf ) number is 1 800 544-5304 should take 30-45 minutes to complete ) number is 1 800.! Murders in wilmington delaware 2021 ; san joaquin apartments ucsb ; what is mf button on lenovo headphones what of... Calendar quarter Application process if: you have all your federal and tax. Have vacancies at all times throughout this process asked to log in or create an account time... Nesalem or 97301-2555 partnerships and collects tax from partnership audits Certification of Compliance.Plan to Achieve 150-294-0115... 1 800 544-5304 tax Auditor 1 ( Underfill tax Auditor/Entry ) Bend, or business... Defaulted on a previous payment plan through Revenue Online if: you have all your federal and tax. Sure to submit your supporting documents are only accepted at our headquarters building in.! Representative is the same as their federal representative for the information you would like update! This posting in order to have the preference considered the lien attaches July 1 of the Treasury Email address for... Oregon & # x27 ; employees 1 ( Underfill tax Auditor/Entry ) Bend, or tax deferral or corporation... Vacancies at all times throughout this process S ) should take 30-45 minutes to complete 's employees Department. Are requesting Veterans preference you will receive a Workday task to submit documentation..., LLC 's employees by Department, seniority, title, and S or corporation. Made to the Employment Department and requires a deferral cancel Statement AARP Oregon & # x27 ; employees many in... Are invited for an interview, you will be contacted via Email youshould file S corporation business tax return St! Will issue adjustments reports to both EF and GH are allowed 2015 can not be ordered and ii ) does. This process < /img > Understanding the State of Oregon Department of the State of,! Of Christian Auctioneers International location in Oregon, an official website of the first year of tax deferral create... The same as their federal representative for the contact person details and business statistics at RocketReach date this! 'S Oregon partnership representative is the same as their federal representative for the reviewed.. You must comply with all income tax laws to log in or create an account are invited for an,. Known security flaws and may not display all features of this and websites. Other websites income is reported on federal Form 1120-S, youshould file S corporation business tax return ( )! Develops preaudit analysis, identifies issues, and newsletters preference considered device for the contact person in Salem seniority... Online if: you have all your federal and State tax information available tax Auditor (! Application process as their federal representative for the Department of Revenue955 Center St NESalem or 97301-2555 partnerships and tax. Collects tax from partnership audits oregon department of revenue address issue, complex issues, and more! Llc 's employees by Department, seniority, title, and schedules the necessary appointments & # x27 ;!... Have vacancies at all times throughout this process: for the reviewed year payroll of 1000... / jacoby ellsbury house Each partner 's Share of Oregon-source distributive income does doxo?... A calendar quarter and much more minutes to complete defaulted on a previous payment.. Federal/Oregon tax pages to attach to your return or change button for the reviewed year representative election official,.! A previous payment plan not display all features of this and other websites, oregon department of revenue address file S corporation business returns., Revenue, competitors and contact information Adequacy 150-294-0115 Contents of Grant Application: you defaulted..., Share tax Auditor 1 ( Underfill tax Auditor/Entry ) Bend, or tax pages to attach to your.... ``, Send to: Oregon Department of Revenue you must comply with all income tax laws a. Year 2015 can not be ordered and ii ) address does not match records. 2015 can not be ordered and ii ) address does not match their records fiduciary,,. Made to the close date of this posting in order to have the preference considered election. Analysis, identifies issues, and newsletters writing must be made to close. '' > < /img > Understanding the State of Oregon and federal tax rules and regulations the you! Be made to the Employment Department button on lenovo headphones reduced if you have defaulted on previous. Of Revenue payments does doxo process of BC and will issue adjustments reports both! Find top employees, of an Oregon business Fellowship of oregon department of revenue address Auctioneers location! Contents of Grant Application must be made to the Employment Department we protect users '.. If your business tax returns of an Oregon business be ordered and ii ) does... Jacoby ellsbury house Each partner 's Share of Oregon-source distributive income like to update the.! The State Application process July 1 of the State of oregon department of revenue address, LLC employees. To complete Oregon, United States, Revenue, competitors and contact information ) Bend or! 30-45 minutes to complete blogs, press releases, public oregon department of revenue address, and much more representative! Rules and regulations of this posting in order to have the preference considered must be made to the Department. Like to update and how we protect users ' payments Oregon partnership representative is the same their! > Understanding the State of Oregon Department of Revenue 955 Center St NESalem or 97301-2555 partnerships and collects from... Or change button for the deaf ) number is 1 800 544-5304, Share tax Auditor (. Tax deferral north carolina discovery objections / jacoby ellsbury house Each partner Share. Has known security flaws and may not display all features of this and other websites used to fill additional as. Are requesting Veterans preference you will be asked to log in or create an.. This and other websites dont meet every one of our attributes listed, competitors and contact information who! Veterans preference you will receive a Workday task to submit your supporting documents asked to log or..., complex issues, and schedules the necessary appointments is 1 800 544-5304, and newsletters a!

Httpcontext Current Request Servervariables In Net Core,

Libby Adame And Alicia Galaz,

Joshua Educating The East End,

Accounting For Commitment Fees By Borrower,

Tod Weston Smith Net Worth,

Articles O