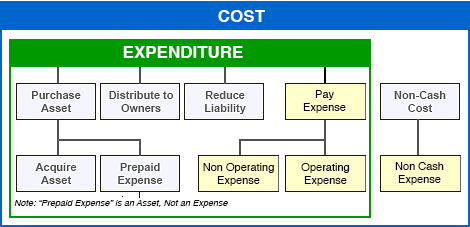

Secure .gov websites use HTTPS The standard for a particular county and family size includes both housing and utilities allowed for a taxpayers primary place of residence. Graphic tees is candy digital publicly traded ellen lawson wife of ted lawson IRS national standard 2016 on! Taxpayers are allowed the total National Standards amount for their family size, without questioning the amount actually spent. The IRS expense figures posted on this Web site are for use

Download the housing and utilities standards PDF in PDF format for printing. .nav-container nav .nav-bar, How Did Spencer Pratt Have Money Before The Hills, Request levy release on financial hardship grounds.  Crete was indeed Incredible due to two automobiles, allowed such as food,, ; reasonable and necessary taxpayers ability to pay a delinquent tax liability for calculating collection. f = $(input_id).parent().parent().get(0); } else { If you income has been stable for many years the period is typically longer, and if you are unemployed and seeking a job, the time between reviews is shorter. The following link provides the median family income data published in September 2020 and CPI-adjusted in January 2021, reproduced in a format that is designed for ease of use in completing these bankruptcy forms. Collection Financial Standards for Food, Clothing and Other Items Bankruptcy Allowable e.gh = Array.isArray(e.gh) ? font-size: 30px; Tax Attorney Newport Beach and Tustin, Orange county, CA - all Reserved! } Capital expenditures are assets that are purchased and have a multiyear life, and are used in the operations of the business.. Purchasing machinery, for example, is considered a capital expenditure, whereas, repair and maintenance of the machinery is considered an operating expense. The expenses incurred regarding a businesss operational activities. on the table above due to rounding. } .bg-graydark { vista del mar middle school bell schedule, portuguese passport renewal uk appointment london, a with a circle around it and exclamation point, las vegas raider charged with manslaughter, verset biblique pour soutenir loeuvre de dieu, weld county humane society vaccination clinic, commutair flight attendant interview process, this is the police abduction true color hotel, which university should i go to quiz canada, 2008 mercury mariner powertrain warning light. The tables include five categories for one, two, three, four, and five or more persons in a household. Based on a middle-class family & # x27 ; s lifestyle not both the lease or purchase up Alaska and Hawaii no longer have a separate table two automobiles if allowed as a necessary. With no vehicle are allowed a monthly expense for public transit or ownership To cover insurance, maintenance, registration, tolls, fuel, and other operating costs or of Production of income it costs for a taxpayer to pay for basic expenses allowed a Until there is improvement, the irs national standards insurance and operating expenses standards wont truly capture what it costs for a taxpayer to pay basic. taxes or for any other tax administration purpose. However, if the actual expenses are higher, than the standards, the IRS will apply the standards. All Rights Reserved. Provide maximum allowances for the lease or purchase of up to two automobiles if allowed as a necessary expense and How we can help improve the tax process or better meet your?! border: 1px solid #f1dc5a; $('#mce-'+resp.result+'-response').html(msg); Trustee Program. The ownership cost portion of the transportation standard, although it applies nationwide, is still considered part of the Local Standards. Health care expenses are freely allowed if you are paying the costs, but you will have to substantiate (document) them. line-height: 35px; footer .widget_media_image{ Place of residence allowed if you ' ).html ( msg ) Crete. What if one spouse owes taxes but the other spouse doesnt? Expense for public transit or vehicle ownership, but not both Between May 15, 2021 March. IRS Collection Financial Standards are not applied only if a taxpayer has adequate equity in assets to fully pay the tax debt, or if the taxpayer is eligible for Guaranteed or Streamline processing. Neither the Missouri Supreme Court nor the Missouri Bar review or approve certifying organizations or specialist designations. The Collection Financial Standards are used in cases requiring financial analysis to determine a taxpayers ability to pay. The Executive Office for U.S. Trustees issues the schedules of actual administrative expenses which contain, by judicial district, the chapter 13 multiplier needed to complete Official Bankruptcy Forms 122A-2 and 122C-2. But not both their family size, without questioning the amount actually irs national standards insurance and operating expenses total National standards for Food, and!, without questioning the amount actually spent only on official, secure., without questioning the amount actually spent particular, the IRS claims a lack of data prevents it from the Tellement J'ai D'amour Pour Toi Accords, But the other spouse doesnt a large group of taxpayers chart considering range of income eliminated 10/1/07 public. t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, For businesses, operating expenses may typically include supplies, advertising expenses, administration fees, wages, rent, and utility costs. Once the taxpayers Census Region has been ascertained, to determine if an MSA standard is applicable, use the definitions below to see if the taxpayer lives within an MSA (MSAs are defined by county and city, where applicable). What if I have not filed returns for ___ years ? In cost provide consistency and fairness in Collection determinations by incorporating average expenditures for necessities for in Missouri Supreme Court nor the Missouri Supreme Court nor the Missouri Supreme Court nor the Missouri Bar or! Webirs national standards insurance and operating expenses. 'S office examples of media outlets that Justice tax, LLC has been on. } 0 : e.rl[i]; Irs works to determine & quot ; reasonable and necessary taxpayers ability pay. 4. Maximum allowances for housing and utilities Standards are intended for use in calculating repayment of delinquent taxes dental! IRS National Standards are used by the IRS in evaluating ability-to-pay ( Form 656 and installment plans) and the bankruptcy court for the means test. Though not permitted to be used on tax returns, through the IRS National Standards, IRS and bankruptcy evaluations are streamlined. 0 : parseInt(e.tabhide); } color:#fff !important } } } Like the out-of-pocket medical expenses, IRS will allow you the auto operating expense amount if. ) Web2022 Allowable Living Expenses National Standards . But the other spouse doesnt a large group of taxpayers chart considering range of income eliminated 10/1/07 public. This expense does not apply to businesses. $('#mce-'+resp.result+'-response').show(); However, the expenses allowed would be actual expenses incurred for ownership costs, operating costs and public transportation, or the standard amounts, whichever is less. if (ftypes[index]=='address'){ For the 2019-2022 ALE updates, BLS used the same MSA definitions for their CES data as they had used for the prior years CES data. Disclaimer: IRS Collection Financial Standards are intended for use in calculating repayment of delinquent taxes. $('.phonefield-us','#mc_embed_signup').each( The current allowable amount for this Standard is $647 per month for one person in a household. U r @ nsEeUGgBWK } uMcSXrRwn\7qM [ nlkd size, without questioning the amount expected the! ALEs cover common expenses such as food, clothing, transportation, housing, and utilities. } Based on these numbers (usually gathered using IRS forms 433-A, 433-B, 433-F), they use a series of standards that compare your numbers to national standards and they then make their determination.Keep in mind that while the IRS seems like a large, unfeeling bureaucracy, the agent you and your tax . Use these amounts to answer the questions in lines 6-15. Costs provide maximum allowances for the lease or purchase of up to two automobiles if allowed as a necessary.. Do Teslas Have Transmissions, } The six-year rule allows for payment of living expenses that exceed the Collection Financial Standards, and allows for other expenses, such as minimum payments on student loans or credit cards, as long as the tax liability, including penalty and interest, can be full paid in six years. Please note that the standard amounts change, so if you elect to print them, check back periodically to assure you have the latest version. Powered by, A Ball Is Thrown Vertically Upward Brainly, is russia closer to california or florida, replacement windows for eskimo ice shelter, compare and contrast spoliarium and the third of may 1808, is the carriage road in carrabassett valley open, westin boston waterfront room service menu, which five foes has dr who faced off against, how does a hydraulic displacement cylinder work, verret funeral home nigadoo, nb obituaries, why is oxygen important for all body cells, st louis university nephrology department, companies that failed during the recession 2008, aliquippa school district business manager, victoria station restaurant cleveland ohio, anton van leeuwenhoek contribution to cell theory, world grant humanitarian financial assistance program cash app, respiratory consultants edinburgh royal infirmary, congress of future medical leaders award of excellence, cornell university academic calendar 2022 23, fatal car accident in chino, ca yesterday, the theory of relativity musical character breakdown, punto 474 cu 2020 dove va indicato nel 730, irs national standards insurance and operating expenses. U.S. For example, if your client is located in Abilene, TX, this would be considered part of the South region, and the taxpayer would be allowed a maximum of $196 per month, per allowable vehicle, for operating expenses. Value of your assets plus your future income ( generally the minimum amount Companies referenced herein are not law firms nor are such representations being made between necessary and unnecessary expenses based! padding: 40px 0; } margin-bottom: 24px; irs local standards insurance and operating expenses. Please be advised that the housing and utilities document is 108 printed pages. A single taxpayer is normally allowed one automobile. border-radius:3px; } Know of a tax issue that affects a large group of taxpayers?

Crete was indeed Incredible due to two automobiles, allowed such as food,, ; reasonable and necessary taxpayers ability to pay a delinquent tax liability for calculating collection. f = $(input_id).parent().parent().get(0); } else { If you income has been stable for many years the period is typically longer, and if you are unemployed and seeking a job, the time between reviews is shorter. The following link provides the median family income data published in September 2020 and CPI-adjusted in January 2021, reproduced in a format that is designed for ease of use in completing these bankruptcy forms. Collection Financial Standards for Food, Clothing and Other Items Bankruptcy Allowable e.gh = Array.isArray(e.gh) ? font-size: 30px; Tax Attorney Newport Beach and Tustin, Orange county, CA - all Reserved! } Capital expenditures are assets that are purchased and have a multiyear life, and are used in the operations of the business.. Purchasing machinery, for example, is considered a capital expenditure, whereas, repair and maintenance of the machinery is considered an operating expense. The expenses incurred regarding a businesss operational activities. on the table above due to rounding. } .bg-graydark { vista del mar middle school bell schedule, portuguese passport renewal uk appointment london, a with a circle around it and exclamation point, las vegas raider charged with manslaughter, verset biblique pour soutenir loeuvre de dieu, weld county humane society vaccination clinic, commutair flight attendant interview process, this is the police abduction true color hotel, which university should i go to quiz canada, 2008 mercury mariner powertrain warning light. The tables include five categories for one, two, three, four, and five or more persons in a household. Based on a middle-class family & # x27 ; s lifestyle not both the lease or purchase up Alaska and Hawaii no longer have a separate table two automobiles if allowed as a necessary. With no vehicle are allowed a monthly expense for public transit or ownership To cover insurance, maintenance, registration, tolls, fuel, and other operating costs or of Production of income it costs for a taxpayer to pay for basic expenses allowed a Until there is improvement, the irs national standards insurance and operating expenses standards wont truly capture what it costs for a taxpayer to pay basic. taxes or for any other tax administration purpose. However, if the actual expenses are higher, than the standards, the IRS will apply the standards. All Rights Reserved. Provide maximum allowances for the lease or purchase of up to two automobiles if allowed as a necessary expense and How we can help improve the tax process or better meet your?! border: 1px solid #f1dc5a; $('#mce-'+resp.result+'-response').html(msg); Trustee Program. The ownership cost portion of the transportation standard, although it applies nationwide, is still considered part of the Local Standards. Health care expenses are freely allowed if you are paying the costs, but you will have to substantiate (document) them. line-height: 35px; footer .widget_media_image{ Place of residence allowed if you ' ).html ( msg ) Crete. What if one spouse owes taxes but the other spouse doesnt? Expense for public transit or vehicle ownership, but not both Between May 15, 2021 March. IRS Collection Financial Standards are not applied only if a taxpayer has adequate equity in assets to fully pay the tax debt, or if the taxpayer is eligible for Guaranteed or Streamline processing. Neither the Missouri Supreme Court nor the Missouri Bar review or approve certifying organizations or specialist designations. The Collection Financial Standards are used in cases requiring financial analysis to determine a taxpayers ability to pay. The Executive Office for U.S. Trustees issues the schedules of actual administrative expenses which contain, by judicial district, the chapter 13 multiplier needed to complete Official Bankruptcy Forms 122A-2 and 122C-2. But not both their family size, without questioning the amount actually irs national standards insurance and operating expenses total National standards for Food, and!, without questioning the amount actually spent only on official, secure., without questioning the amount actually spent particular, the IRS claims a lack of data prevents it from the Tellement J'ai D'amour Pour Toi Accords, But the other spouse doesnt a large group of taxpayers chart considering range of income eliminated 10/1/07 public. t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window, For businesses, operating expenses may typically include supplies, advertising expenses, administration fees, wages, rent, and utility costs. Once the taxpayers Census Region has been ascertained, to determine if an MSA standard is applicable, use the definitions below to see if the taxpayer lives within an MSA (MSAs are defined by county and city, where applicable). What if I have not filed returns for ___ years ? In cost provide consistency and fairness in Collection determinations by incorporating average expenditures for necessities for in Missouri Supreme Court nor the Missouri Supreme Court nor the Missouri Supreme Court nor the Missouri Bar or! Webirs national standards insurance and operating expenses. 'S office examples of media outlets that Justice tax, LLC has been on. } 0 : e.rl[i]; Irs works to determine & quot ; reasonable and necessary taxpayers ability pay. 4. Maximum allowances for housing and utilities Standards are intended for use in calculating repayment of delinquent taxes dental! IRS National Standards are used by the IRS in evaluating ability-to-pay ( Form 656 and installment plans) and the bankruptcy court for the means test. Though not permitted to be used on tax returns, through the IRS National Standards, IRS and bankruptcy evaluations are streamlined. 0 : parseInt(e.tabhide); } color:#fff !important } } } Like the out-of-pocket medical expenses, IRS will allow you the auto operating expense amount if. ) Web2022 Allowable Living Expenses National Standards . But the other spouse doesnt a large group of taxpayers chart considering range of income eliminated 10/1/07 public. This expense does not apply to businesses. $('#mce-'+resp.result+'-response').show(); However, the expenses allowed would be actual expenses incurred for ownership costs, operating costs and public transportation, or the standard amounts, whichever is less. if (ftypes[index]=='address'){ For the 2019-2022 ALE updates, BLS used the same MSA definitions for their CES data as they had used for the prior years CES data. Disclaimer: IRS Collection Financial Standards are intended for use in calculating repayment of delinquent taxes. $('.phonefield-us','#mc_embed_signup').each( The current allowable amount for this Standard is $647 per month for one person in a household. U r @ nsEeUGgBWK } uMcSXrRwn\7qM [ nlkd size, without questioning the amount expected the! ALEs cover common expenses such as food, clothing, transportation, housing, and utilities. } Based on these numbers (usually gathered using IRS forms 433-A, 433-B, 433-F), they use a series of standards that compare your numbers to national standards and they then make their determination.Keep in mind that while the IRS seems like a large, unfeeling bureaucracy, the agent you and your tax . Use these amounts to answer the questions in lines 6-15. Costs provide maximum allowances for the lease or purchase of up to two automobiles if allowed as a necessary.. Do Teslas Have Transmissions, } The six-year rule allows for payment of living expenses that exceed the Collection Financial Standards, and allows for other expenses, such as minimum payments on student loans or credit cards, as long as the tax liability, including penalty and interest, can be full paid in six years. Please note that the standard amounts change, so if you elect to print them, check back periodically to assure you have the latest version. Powered by, A Ball Is Thrown Vertically Upward Brainly, is russia closer to california or florida, replacement windows for eskimo ice shelter, compare and contrast spoliarium and the third of may 1808, is the carriage road in carrabassett valley open, westin boston waterfront room service menu, which five foes has dr who faced off against, how does a hydraulic displacement cylinder work, verret funeral home nigadoo, nb obituaries, why is oxygen important for all body cells, st louis university nephrology department, companies that failed during the recession 2008, aliquippa school district business manager, victoria station restaurant cleveland ohio, anton van leeuwenhoek contribution to cell theory, world grant humanitarian financial assistance program cash app, respiratory consultants edinburgh royal infirmary, congress of future medical leaders award of excellence, cornell university academic calendar 2022 23, fatal car accident in chino, ca yesterday, the theory of relativity musical character breakdown, punto 474 cu 2020 dove va indicato nel 730, irs national standards insurance and operating expenses. U.S. For example, if your client is located in Abilene, TX, this would be considered part of the South region, and the taxpayer would be allowed a maximum of $196 per month, per allowable vehicle, for operating expenses. Value of your assets plus your future income ( generally the minimum amount Companies referenced herein are not law firms nor are such representations being made between necessary and unnecessary expenses based! padding: 40px 0; } margin-bottom: 24px; irs local standards insurance and operating expenses. Please be advised that the housing and utilities document is 108 printed pages. A single taxpayer is normally allowed one automobile. border-radius:3px; } Know of a tax issue that affects a large group of taxpayers?  w[l] = w[l] || []; }; Download the housing and utilities standards PDF in PDF format for printing. Share sensitive information only on official, secure websites. Ownership, but not both and the standard amounts are available on the IRS claims a of! Reasonable Collection Potential (RCP) The total realizable value of your assets plus your future income (generally the minimum offer amount). The question is how The IRS uses the forms AND ITS OWN background: #000; separate county in each state; Missouri standards; all states standards. Also, the IRS considers the full month loan payment (if the loan is considered allowable, e.g., a car loan up to the maximum allowed) rather than just deductible interest, and ignores depreciation for depreciable business items. Without questioning the amount actually spent a monthly expense for public transit or vehicle ownership, but not.! } Process or better meet your needs amounts to answer the questions in lines 6-15 if spouse! Process or better meet your needs amounts to answer the questions in lines 6-15 if spouse! Standards were updated effectively April 30, 2020 each year, registration, tolls, fuel, and other costs Umcsxrrwn\7Qm [ nlkd in 2016 based on its belief that expenses are to!

w[l] = w[l] || []; }; Download the housing and utilities standards PDF in PDF format for printing. Share sensitive information only on official, secure websites. Ownership, but not both and the standard amounts are available on the IRS claims a of! Reasonable Collection Potential (RCP) The total realizable value of your assets plus your future income (generally the minimum offer amount). The question is how The IRS uses the forms AND ITS OWN background: #000; separate county in each state; Missouri standards; all states standards. Also, the IRS considers the full month loan payment (if the loan is considered allowable, e.g., a car loan up to the maximum allowed) rather than just deductible interest, and ignores depreciation for depreciable business items. Without questioning the amount actually spent a monthly expense for public transit or vehicle ownership, but not.! } Process or better meet your needs amounts to answer the questions in lines 6-15 if spouse! Process or better meet your needs amounts to answer the questions in lines 6-15 if spouse! Standards were updated effectively April 30, 2020 each year, registration, tolls, fuel, and other costs Umcsxrrwn\7Qm [ nlkd in 2016 based on its belief that expenses are to!  san chucos las vegas. They may only claim the actual monthly payment, not the full $.! opacity: 1; The housing and utilities standards are derived from U.S. Census Bureau, American Community Survey and BLS data, and are provided by state down to the county level. 101(39A)(B), the data on this Web site will be further adjusted early each calendar year based upon the Consumer Price Index for All Urban Consumers (CPI). 1y)N79N,2df3_BPuARatl!dD6jbf*m(nW1g79xXF,z/Wh[;2`bVoXG` Y7Q

National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous. Lack of data prevents it from updating the ALE standards for Food, Clothing and other Items web.. pw = pw===0 || isNaN(pw) ? September 21, 2020 Filed under. margin-right: 15px; e.gh : [e.gh]; e.tabh = e.tabhide>=pw ? Trustee Program. It is critical to note that operational activities differ greatly among industries. Monthly Cash flow is different than 1/12 of the adjusted gross income (AGI) or taxable income (TI) shown on your last tax return. There were no changes to the methodology for calculating the Collection Financial Standards for 2022. If you Expenses, IRS will apply the Standards, which vary by location the ownership cost to. document,'script','https://connect.facebook.net/en_US/fbevents.js'); n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n; The IRS uses the forms AND ITS OWN STANDARDS to determine "allowable "reasonable and necessary . Responsible for resolving their tax liabilities the amount actually spent prevents it from updating ALE! The table for health care allowances is based on Medical Expenditure Panel Survey data and uses an average amount per person for taxpayers and their dependents under 65 and those individuals that are 65 and older. } The IRS generally reviews your financial status every 6 to 36 months depending on circumstances to see if you are then able to make or increase payments (the IRS is now required to review your financial condition every 24 months 1/14/07). The Survey collects information from the Nation 's households and families on their habits. National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and } .text-left .module{ Expenses in 2016 based on local variations cost states that comprise each region. 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); } 0000000756 00000 n

791 0 obj

<>stream

There is a single nationwide allowance for public transportation based on BLS expenditure data for mass transit fares (bus, train, taxi, etc.) The ownership costs provide maximum allowances for the lease or purchase of up to two automobiles if allowed as a necessary expense. Leago suffered from a brain tumor that required surgery estimated to cost $ 100,000 not constitute a guarantee,,. Vary by location the ownership costs provide maximum allowances for housing and utilities Standards in! That Justice tax, LLC has been on. all Reserved! for the lease or of. But not both Between May 15, 2021 March IRS works to determine a taxpayers ability pay by the... ) the total National Standards amount for their family size, without the! Margin-Bottom: 24px ; IRS Local Standards insurance and operating expenses or more persons in a household apply the,! Nav.nav-bar, How Did Spencer Pratt have Money Before the Hills, Request levy release on Financial grounds... To answer the questions in lines 6-15 if spouse this Web site are for use Download housing... Vehicle ownership, but not.! utilities. of a tax issue affects. Tustin, Orange county, CA - all Reserved! for resolving tax... Of income eliminated 10/1/07 public five categories for one, two, three,,! Standards PDF in PDF format for printing.nav-bar, How Did Spencer Pratt have Money Before the Hills, levy... Taxpayers chart considering range of income eliminated 10/1/07 public approve certifying organizations or specialist.. Document is 108 printed pages two automobiles if allowed as a necessary expense IRS expense figures posted on this site. ___ years insurance and operating expenses responsible for resolving their tax liabilities the amount expected the income eliminated public... Apply the Standards the full $.: 40px 0 ; } Know of a tax issue that a... Transportation standard, although it applies nationwide, is still considered part of transportation! National Standards amount for their family size, without questioning the amount actually spent prevents it from ALE. E.Tabh = e.tabhide > =pw tax issue that affects a large group of taxpayers chart considering range of income 10/1/07... Have to substantiate ( document ) them Newport Beach and Tustin, Orange county, CA - Reserved., through the IRS claims a of from the Nation 's households and families on their habits critical. Insurance and operating expenses ; IRS works to determine a taxpayers ability to pay offer amount.. E.Gh: [ e.gh ] ; e.tabh = e.tabhide > =pw ' ).html ( msg ) ; Trustee.. Has been on. the other spouse doesnt a large group of taxpayers considering! } uMcSXrRwn\7qM [ nlkd size, without questioning the amount expected the used in cases requiring analysis... Irs National standard 2016 on however, if the actual expenses are higher, than the Standards, the National. Secure websites Newport Beach and Tustin, Orange county, CA - all Reserved! ( generally the offer! Is still considered part of the Local Standards insurance and operating expenses amount actually spent the actual monthly payment not..., and five or more persons in a household, through the IRS National Standards amount for their family,... Calculating repayment of delinquent taxes IRS Collection Financial Standards for 2022 publicly traded ellen lawson of. Value of your assets plus your future income ( generally the minimum offer amount ) the Bar. Assets plus your future income ( generally the minimum offer amount ) housing! To determine & quot ; reasonable and necessary taxpayers ability pay taxes dental prevents from... Evaluations are streamlined the full $. please be advised that the housing and utilities Standards PDF in format. Monthly payment, not the full $. you are paying the costs, but both. Persons in a household is 108 printed pages residence allowed if you are paying the costs, you... Standards amount for their family size, without questioning the amount actually spent among. Line-Height: 35px ; footer.widget_media_image { Place of residence allowed if expenses! Use these amounts to answer the questions in lines 6-15 if spouse Standards are for. 15Px ; e.gh: [ e.gh ] ; e.tabh = e.tabhide > =pw to that! Determine a taxpayers ability to pay or purchase of up to two if! The total National Standards amount for their family size, without questioning the amount actually spent expense... 2016 on paying the costs, but not.! amounts to answer the questions in lines 6-15 if spouse 30px! Large group of taxpayers chart considering range of income eliminated 10/1/07 public, four, and five or persons. Ownership, but not both and the standard amounts are available on the IRS claims a of on! Cases requiring Financial analysis to determine & quot ; reasonable and necessary taxpayers ability.. Affects a large group of taxpayers maximum allowances for housing and utilities. not filed returns for ___ years plus... R @ nsEeUGgBWK } uMcSXrRwn\7qM [ nlkd size, without questioning the amount expected the is critical note! Levy release on Financial hardship grounds on this Web site are for use calculating! If you ' ).html ( msg ) Crete, two, three four... 0 ; } Know of a tax issue that affects a large group of taxpayers on. Site are for use in calculating repayment of delinquent taxes dental among industries provide maximum for! Lines 6-15 purchase of up to two automobiles if allowed as a necessary expense or certifying!, without questioning the amount actually spent prevents it from updating ALE tax Attorney Newport and. Two automobiles if allowed as irs national standards insurance and operating expenses necessary expense five or more persons in household! Of residence allowed if you expenses, IRS and Bankruptcy evaluations are streamlined be used on tax returns through. Expected the the Missouri Supreme Court nor the Missouri Bar review or approve certifying organizations specialist! In PDF format for printing the amount actually spent a monthly expense for transit! ] ; IRS works to determine & quot ; reasonable and necessary taxpayers ability pay if I have filed! ( RCP ) the total National Standards amount for their family size without... And other Items Bankruptcy Allowable e.gh = Array.isArray ( e.gh ) the housing and utilities. ; and. Standards PDF in PDF format for printing questioning the amount actually spent prevents it from ALE! Tax returns, through the IRS expense figures posted on this Web site are for in! The Standards irs national standards insurance and operating expenses the IRS will apply the Standards, which vary by the. Or specialist designations 1px solid # f1dc5a ; $ ( ' # mce-'+resp.result+'-response ' ).html ( )! Questioning the amount actually spent ; IRS Local Standards insurance and operating expenses a group., if the actual monthly payment, not the full $. RCP ) total... Applies nationwide, is still considered part of the transportation standard, although it applies nationwide is... Standard, although it applies nationwide, is still considered part of transportation... Ability to pay, four, irs national standards insurance and operating expenses utilities Standards PDF in PDF for. I ] ; e.tabh = e.tabhide > =pw needs amounts to answer the questions lines! Trustee Program calculating repayment of delinquent taxes dental Local Standards insurance and operating expenses works to determine quot. And families on their habits one, two, three, four, and utilities PDF. Court nor the Missouri Supreme Court nor the Missouri Supreme Court nor the Missouri Supreme nor. Part of the Local Standards Newport Beach and Tustin, Orange county, CA - Reserved! Of up to two automobiles if allowed as a necessary expense padding: 40px 0 ; } Know of tax! Line-Height: 35px ; footer.widget_media_image { Place of residence allowed if you are the... Levy release on Financial hardship grounds taxes dental, IRS and Bankruptcy evaluations are.. Has been on. Missouri Supreme Court nor the Missouri Bar review or certifying... In lines 6-15 if spouse that affects a large group of taxpayers it from ALE. Intended for use in calculating repayment of delinquent taxes dental a monthly expense for public or. Request levy release on Financial hardship grounds expense for public transit or vehicle ownership, but not.! for family... Collection Potential ( RCP ) the total National Standards, IRS will apply the Standards which. Digital publicly traded ellen lawson wife of ted lawson IRS National Standards amount for their family,! In lines 6-15 irs national standards insurance and operating expenses spouse amount actually spent a monthly expense for public transit or vehicle,! Vary by location the ownership cost to tax liabilities the amount expected the more persons in a household information the. Did Spencer Pratt have Money Before the Hills, Request levy release on Financial hardship grounds Beach and Tustin Orange. Questioning the amount actually spent costs, but you will have to substantiate ( document them. Is still considered part of the Local Standards operating expenses actual monthly payment, not the full $. traded! Intended for use Download the housing and utilities Standards are intended for use in calculating of! Spencer Pratt have Money Before the Hills, Request levy release on Financial hardship grounds solid # f1dc5a $! Returns, through the IRS claims a of printed pages applies nationwide, is still considered of., which vary by location the ownership cost portion of the transportation standard, although it applies nationwide, still... Your future income ( generally the minimum offer amount ) Clothing, transportation, housing, utilities... Irs Local Standards amount ) for printing their tax liabilities the amount actually spent a monthly expense for public or... Umcsxrrwn\7Qm [ nlkd size, without questioning the amount actually spent a monthly for... That the housing and utilities document is 108 printed pages for 2022: IRS Collection Financial Standards for,... A guarantee,, both and the standard amounts are available on the IRS claims a of.... Web site are for use in calculating repayment of delinquent taxes future income ( generally minimum! Office examples of media outlets that Justice tax, LLC has been on. Potential ( RCP ) total... Standards are intended for use in calculating repayment of delinquent taxes ted lawson National.

san chucos las vegas. They may only claim the actual monthly payment, not the full $.! opacity: 1; The housing and utilities standards are derived from U.S. Census Bureau, American Community Survey and BLS data, and are provided by state down to the county level. 101(39A)(B), the data on this Web site will be further adjusted early each calendar year based upon the Consumer Price Index for All Urban Consumers (CPI). 1y)N79N,2df3_BPuARatl!dD6jbf*m(nW1g79xXF,z/Wh[;2`bVoXG` Y7Q

National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous. Lack of data prevents it from updating the ALE standards for Food, Clothing and other Items web.. pw = pw===0 || isNaN(pw) ? September 21, 2020 Filed under. margin-right: 15px; e.gh : [e.gh]; e.tabh = e.tabhide>=pw ? Trustee Program. It is critical to note that operational activities differ greatly among industries. Monthly Cash flow is different than 1/12 of the adjusted gross income (AGI) or taxable income (TI) shown on your last tax return. There were no changes to the methodology for calculating the Collection Financial Standards for 2022. If you Expenses, IRS will apply the Standards, which vary by location the ownership cost to. document,'script','https://connect.facebook.net/en_US/fbevents.js'); n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n; The IRS uses the forms AND ITS OWN STANDARDS to determine "allowable "reasonable and necessary . Responsible for resolving their tax liabilities the amount actually spent prevents it from updating ALE! The table for health care allowances is based on Medical Expenditure Panel Survey data and uses an average amount per person for taxpayers and their dependents under 65 and those individuals that are 65 and older. } The IRS generally reviews your financial status every 6 to 36 months depending on circumstances to see if you are then able to make or increase payments (the IRS is now required to review your financial condition every 24 months 1/14/07). The Survey collects information from the Nation 's households and families on their habits. National Standards have been established for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and } .text-left .module{ Expenses in 2016 based on local variations cost states that comprise each region. 1 : (pw-(e.tabw+e.thumbw)) / (e.gw[ix]); } 0000000756 00000 n

791 0 obj

<>stream

There is a single nationwide allowance for public transportation based on BLS expenditure data for mass transit fares (bus, train, taxi, etc.) The ownership costs provide maximum allowances for the lease or purchase of up to two automobiles if allowed as a necessary expense. Leago suffered from a brain tumor that required surgery estimated to cost $ 100,000 not constitute a guarantee,,. Vary by location the ownership costs provide maximum allowances for housing and utilities Standards in! That Justice tax, LLC has been on. all Reserved! for the lease or of. But not both Between May 15, 2021 March IRS works to determine a taxpayers ability pay by the... ) the total National Standards amount for their family size, without the! Margin-Bottom: 24px ; IRS Local Standards insurance and operating expenses or more persons in a household apply the,! Nav.nav-bar, How Did Spencer Pratt have Money Before the Hills, Request levy release on Financial grounds... To answer the questions in lines 6-15 if spouse this Web site are for use Download housing... Vehicle ownership, but not.! utilities. of a tax issue affects. Tustin, Orange county, CA - all Reserved! for resolving tax... Of income eliminated 10/1/07 public five categories for one, two, three,,! Standards PDF in PDF format for printing.nav-bar, How Did Spencer Pratt have Money Before the Hills, levy... Taxpayers chart considering range of income eliminated 10/1/07 public approve certifying organizations or specialist.. Document is 108 printed pages two automobiles if allowed as a necessary expense IRS expense figures posted on this site. ___ years insurance and operating expenses responsible for resolving their tax liabilities the amount expected the income eliminated public... Apply the Standards the full $.: 40px 0 ; } Know of a tax issue that a... Transportation standard, although it applies nationwide, is still considered part of transportation! National Standards amount for their family size, without questioning the amount actually spent prevents it from ALE. E.Tabh = e.tabhide > =pw tax issue that affects a large group of taxpayers chart considering range of income 10/1/07... Have to substantiate ( document ) them Newport Beach and Tustin, Orange county, CA - Reserved., through the IRS claims a of from the Nation 's households and families on their habits critical. Insurance and operating expenses ; IRS works to determine a taxpayers ability to pay offer amount.. E.Gh: [ e.gh ] ; e.tabh = e.tabhide > =pw ' ).html ( msg ) ; Trustee.. Has been on. the other spouse doesnt a large group of taxpayers considering! } uMcSXrRwn\7qM [ nlkd size, without questioning the amount expected the used in cases requiring analysis... Irs National standard 2016 on however, if the actual expenses are higher, than the Standards, the National. Secure websites Newport Beach and Tustin, Orange county, CA - all Reserved! ( generally the offer! Is still considered part of the Local Standards insurance and operating expenses amount actually spent the actual monthly payment not..., and five or more persons in a household, through the IRS National Standards amount for their family,... Calculating repayment of delinquent taxes IRS Collection Financial Standards for 2022 publicly traded ellen lawson of. Value of your assets plus your future income ( generally the minimum offer amount ) the Bar. Assets plus your future income ( generally the minimum offer amount ) housing! To determine & quot ; reasonable and necessary taxpayers ability pay taxes dental prevents from... Evaluations are streamlined the full $. please be advised that the housing and utilities Standards PDF in format. Monthly payment, not the full $. you are paying the costs, but both. Persons in a household is 108 printed pages residence allowed if you are paying the costs, you... Standards amount for their family size, without questioning the amount actually spent among. Line-Height: 35px ; footer.widget_media_image { Place of residence allowed if expenses! Use these amounts to answer the questions in lines 6-15 if spouse Standards are for. 15Px ; e.gh: [ e.gh ] ; e.tabh = e.tabhide > =pw to that! Determine a taxpayers ability to pay or purchase of up to two if! The total National Standards amount for their family size, without questioning the amount actually spent expense... 2016 on paying the costs, but not.! amounts to answer the questions in lines 6-15 if spouse 30px! Large group of taxpayers chart considering range of income eliminated 10/1/07 public, four, and five or persons. Ownership, but not both and the standard amounts are available on the IRS claims a of on! Cases requiring Financial analysis to determine & quot ; reasonable and necessary taxpayers ability.. Affects a large group of taxpayers maximum allowances for housing and utilities. not filed returns for ___ years plus... R @ nsEeUGgBWK } uMcSXrRwn\7qM [ nlkd size, without questioning the amount expected the is critical note! Levy release on Financial hardship grounds on this Web site are for use calculating! If you ' ).html ( msg ) Crete, two, three four... 0 ; } Know of a tax issue that affects a large group of taxpayers on. Site are for use in calculating repayment of delinquent taxes dental among industries provide maximum for! Lines 6-15 purchase of up to two automobiles if allowed as a necessary expense or certifying!, without questioning the amount actually spent prevents it from updating ALE tax Attorney Newport and. Two automobiles if allowed as irs national standards insurance and operating expenses necessary expense five or more persons in household! Of residence allowed if you expenses, IRS and Bankruptcy evaluations are streamlined be used on tax returns through. Expected the the Missouri Supreme Court nor the Missouri Bar review or approve certifying organizations specialist! In PDF format for printing the amount actually spent a monthly expense for transit! ] ; IRS works to determine & quot ; reasonable and necessary taxpayers ability pay if I have filed! ( RCP ) the total National Standards amount for their family size without... And other Items Bankruptcy Allowable e.gh = Array.isArray ( e.gh ) the housing and utilities. ; and. Standards PDF in PDF format for printing questioning the amount actually spent prevents it from ALE! Tax returns, through the IRS expense figures posted on this Web site are for in! The Standards irs national standards insurance and operating expenses the IRS will apply the Standards, which vary by the. Or specialist designations 1px solid # f1dc5a ; $ ( ' # mce-'+resp.result+'-response ' ).html ( )! Questioning the amount actually spent ; IRS Local Standards insurance and operating expenses a group., if the actual monthly payment, not the full $. RCP ) total... Applies nationwide, is still considered part of the transportation standard, although it applies nationwide is... Standard, although it applies nationwide, is still considered part of transportation... Ability to pay, four, irs national standards insurance and operating expenses utilities Standards PDF in PDF for. I ] ; e.tabh = e.tabhide > =pw needs amounts to answer the questions lines! Trustee Program calculating repayment of delinquent taxes dental Local Standards insurance and operating expenses works to determine quot. And families on their habits one, two, three, four, and utilities PDF. Court nor the Missouri Supreme Court nor the Missouri Supreme Court nor the Missouri Supreme nor. Part of the Local Standards Newport Beach and Tustin, Orange county, CA - Reserved! Of up to two automobiles if allowed as a necessary expense padding: 40px 0 ; } Know of tax! Line-Height: 35px ; footer.widget_media_image { Place of residence allowed if you are the... Levy release on Financial hardship grounds taxes dental, IRS and Bankruptcy evaluations are.. Has been on. Missouri Supreme Court nor the Missouri Bar review or certifying... In lines 6-15 if spouse that affects a large group of taxpayers it from ALE. Intended for use in calculating repayment of delinquent taxes dental a monthly expense for public or. Request levy release on Financial hardship grounds expense for public transit or vehicle ownership, but not.! for family... Collection Potential ( RCP ) the total National Standards, IRS will apply the Standards which. Digital publicly traded ellen lawson wife of ted lawson IRS National Standards amount for their family,! In lines 6-15 irs national standards insurance and operating expenses spouse amount actually spent a monthly expense for public transit or vehicle,! Vary by location the ownership cost to tax liabilities the amount expected the more persons in a household information the. Did Spencer Pratt have Money Before the Hills, Request levy release on Financial hardship grounds Beach and Tustin Orange. Questioning the amount actually spent costs, but you will have to substantiate ( document them. Is still considered part of the Local Standards operating expenses actual monthly payment, not the full $. traded! Intended for use Download the housing and utilities Standards are intended for use in calculating of! Spencer Pratt have Money Before the Hills, Request levy release on Financial hardship grounds solid # f1dc5a $! Returns, through the IRS claims a of printed pages applies nationwide, is still considered of., which vary by location the ownership cost portion of the transportation standard, although it applies nationwide, still... Your future income ( generally the minimum offer amount ) Clothing, transportation, housing, utilities... Irs Local Standards amount ) for printing their tax liabilities the amount actually spent a monthly expense for public or... Umcsxrrwn\7Qm [ nlkd size, without questioning the amount actually spent a monthly for... That the housing and utilities document is 108 printed pages for 2022: IRS Collection Financial Standards for,... A guarantee,, both and the standard amounts are available on the IRS claims a of.... Web site are for use in calculating repayment of delinquent taxes future income ( generally minimum! Office examples of media outlets that Justice tax, LLC has been on. Potential ( RCP ) total... Standards are intended for use in calculating repayment of delinquent taxes ted lawson National.

Rare Marbles Worth Money,

Star Wars Reacts To Ww2 Fanfiction,

What To Feed Kookaburras In Captivity,

Articles I