Ryan Selwood has been appointed the interim Senior Lead of our San Francisco office, while maintaining his role as Managing Director, Head of Direct Private Equity. The CPP is designed to serve todays contributors and beneficiaries while looking ahead to future decades and across multiple generations. WebPorque En Auto-Educarte Para El Futuro Est Tu Fortuna. This is just an excerpt. The additional CPP account achieved a 1.9% net return for the quarter.  Weighted SWOT analysis process is a three stage process Our Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board recommendation memos are concisely written and exhibit and illustrate the clear strategic thought process of the protagonist in the case study.

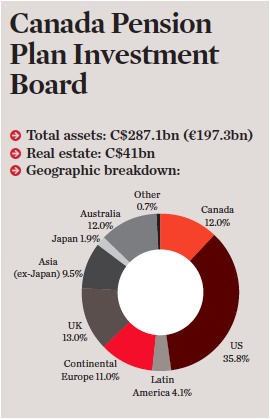

Weighted SWOT analysis process is a three stage process Our Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board recommendation memos are concisely written and exhibit and illustrate the clear strategic thought process of the protagonist in the case study.  Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board case study is a Harvard Business School (HBR) case study written by Andrew Ang. The Report on Sustainable Investing provides a comprehensive review of the actions CPPIB took over the previous year to manage ESG factors to enhance the long-term value of the CPP Fund. Announced plans to sell Liberty Living, a wholly owned student accommodation business, to the Unite Group plc for cash proceeds of approximately $1.3 billion, retaining a 20% share in the combined group. The joint venture will target an investment of up to R$1 billion in combined equity. For more information about CPPIB, please visitwww.cppib.comor follow us onLinkedIn,FacebookorTwitter. Sold our 50% stake in Edmonton City Centre, a 1.4-million-square-foot retail and office complex in Edmonton, Alberta. Assessing feasibility of the new initiative in Finance & Accounting field. For the quarter, the Fund returned 2.3% net of all CPPIB costs. Committed to invest 500 million in Traviata I S. r.l., a holding company that is preparing to acquire media and technology company Axel Springer SE, alongside funds advised by KKR.About Canada Pension Plan Investment Board CPP Investment Board case study TomLondon IB Rank: Monkey | 60 I'm interviewing for an analyst position in the infrastructure team of the CPP Investment If you are looking for MBA, Executive MBA or Corporate / Professional level recommendation memo then feel free to connect with us. How do you think that you could improve your current LinkedIn profile to. The Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board (referred as Cppib Reference from here on) case study provides evaluation & decision scenario in field of Finance & Accounting. In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. At June 30, 2019, the CPP Fund totalled$400.6 billion. To learn more about our approach to sustainable investing or read the 2019 Report on Sustainable Investing, clickhereand follow us at @CPPIB. During this time, our teams continued to lay the groundwork for future value creation. A case study is a detailed study of a specific subject, such as a person, group, place, event, organization, or phenomenon. The additional CPP account ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $1.2 billion, compared to $0.9 billion at the end of the first quarter of fiscal 2020. The Reference Portfolio played an integral role in allowing CPPIB to look through the labels of asset classes and to holistically consider each asset in terms of its underlying factors. As a comparative advantage, an extended investment horizon helps to define CPPIBs strategy and risk appetite. CPPIB has a 45% ownership interest in the joint venture, with Boston Properties retaining the remaining 55% ownership stake. Kotler & Armstrong (2017) "Principles of Marketing Management Management", Published by Pearson Publications. CPPIB controls a 50.01% stake in 407 International Inc. What is the desired sequence of activities and key milestones in the course of implementation of the recommendations. In this section you should present the details of What to do, how to do it and when to do it. The assumptions are often your business judgment based on industry knowledge and facts provided in case study analysis. Forward-looking information and statements often but not always use words such as trend, potential, opportunity, believe, expect, anticipate, current, intention, estimate, position, assume, outlook, continue, remain, maintain, sustain, seek, achieve, and similar expressions, or future or conditional verbs such as will, would, should, could, may and similar expressions. WebFor direct investments, we invest in private Asian companies alongside private equity fund partners (GPs) and certain qualified non-GP partners. CPPIB acquired its initial ownership interest in Lendlease International Towers Sydney Trust in 2012.Transaction highlights following the quarter end include:Formed a joint venture with Cyrela Brazil Realty (Cyrela) to develop a portfolio of residential real estate across select neighborhoods in the city of So Paulo, Brazil. You can conduct a VRIO analysis of Cppib Reference to assess whether the recommended course of action is feasible under the present resources, skills, technological know how, and financial ability of the organization. What it needs to do to improve the conditions. The background paragraph of briefly states the historical context, illustrate the moment that brought the protagonist into the present situation and why she needs to make a decision. Improving business portfolio management of Cppib Reference CPPIB acquired its initial ownership interest in Lendlease International Towers Sydney Trust in 2012. It may involve what are the resources required, how much time it will take. Providing supporting argument and evidences on why each recommendation is unique and need to implemented to change the present situation. In cases like this, which draws upon interviews with Raymond and Denison, pupils are going to learn about the way the Reference Portfolio operates to direct CPPIB's high performing investment strategy, the genesis of the Reference Portfolio, and the history of CPPIB.

Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board case study is a Harvard Business School (HBR) case study written by Andrew Ang. The Report on Sustainable Investing provides a comprehensive review of the actions CPPIB took over the previous year to manage ESG factors to enhance the long-term value of the CPP Fund. Announced plans to sell Liberty Living, a wholly owned student accommodation business, to the Unite Group plc for cash proceeds of approximately $1.3 billion, retaining a 20% share in the combined group. The joint venture will target an investment of up to R$1 billion in combined equity. For more information about CPPIB, please visitwww.cppib.comor follow us onLinkedIn,FacebookorTwitter. Sold our 50% stake in Edmonton City Centre, a 1.4-million-square-foot retail and office complex in Edmonton, Alberta. Assessing feasibility of the new initiative in Finance & Accounting field. For the quarter, the Fund returned 2.3% net of all CPPIB costs. Committed to invest 500 million in Traviata I S. r.l., a holding company that is preparing to acquire media and technology company Axel Springer SE, alongside funds advised by KKR.About Canada Pension Plan Investment Board CPP Investment Board case study TomLondon IB Rank: Monkey | 60 I'm interviewing for an analyst position in the infrastructure team of the CPP Investment If you are looking for MBA, Executive MBA or Corporate / Professional level recommendation memo then feel free to connect with us. How do you think that you could improve your current LinkedIn profile to. The Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board (referred as Cppib Reference from here on) case study provides evaluation & decision scenario in field of Finance & Accounting. In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. At June 30, 2019, the CPP Fund totalled$400.6 billion. To learn more about our approach to sustainable investing or read the 2019 Report on Sustainable Investing, clickhereand follow us at @CPPIB. During this time, our teams continued to lay the groundwork for future value creation. A case study is a detailed study of a specific subject, such as a person, group, place, event, organization, or phenomenon. The additional CPP account ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $1.2 billion, compared to $0.9 billion at the end of the first quarter of fiscal 2020. The Reference Portfolio played an integral role in allowing CPPIB to look through the labels of asset classes and to holistically consider each asset in terms of its underlying factors. As a comparative advantage, an extended investment horizon helps to define CPPIBs strategy and risk appetite. CPPIB has a 45% ownership interest in the joint venture, with Boston Properties retaining the remaining 55% ownership stake. Kotler & Armstrong (2017) "Principles of Marketing Management Management", Published by Pearson Publications. CPPIB controls a 50.01% stake in 407 International Inc. What is the desired sequence of activities and key milestones in the course of implementation of the recommendations. In this section you should present the details of What to do, how to do it and when to do it. The assumptions are often your business judgment based on industry knowledge and facts provided in case study analysis. Forward-looking information and statements often but not always use words such as trend, potential, opportunity, believe, expect, anticipate, current, intention, estimate, position, assume, outlook, continue, remain, maintain, sustain, seek, achieve, and similar expressions, or future or conditional verbs such as will, would, should, could, may and similar expressions. WebFor direct investments, we invest in private Asian companies alongside private equity fund partners (GPs) and certain qualified non-GP partners. CPPIB acquired its initial ownership interest in Lendlease International Towers Sydney Trust in 2012.Transaction highlights following the quarter end include:Formed a joint venture with Cyrela Brazil Realty (Cyrela) to develop a portfolio of residential real estate across select neighborhoods in the city of So Paulo, Brazil. You can conduct a VRIO analysis of Cppib Reference to assess whether the recommended course of action is feasible under the present resources, skills, technological know how, and financial ability of the organization. What it needs to do to improve the conditions. The background paragraph of briefly states the historical context, illustrate the moment that brought the protagonist into the present situation and why she needs to make a decision. Improving business portfolio management of Cppib Reference CPPIB acquired its initial ownership interest in Lendlease International Towers Sydney Trust in 2012. It may involve what are the resources required, how much time it will take. Providing supporting argument and evidences on why each recommendation is unique and need to implemented to change the present situation. In cases like this, which draws upon interviews with Raymond and Denison, pupils are going to learn about the way the Reference Portfolio operates to direct CPPIB's high performing investment strategy, the genesis of the Reference Portfolio, and the history of CPPIB.  In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure, and fixed income instruments. Our ownership interest was initially acquired in 2005. Net proceeds from the transaction are expected to be A$532 million, while still retaining a 36% interest in the Trust. The forward-looking information and statements are not historical facts but reflect CPPIBs current expectations regarding future results or events.

In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure, and fixed income instruments. Our ownership interest was initially acquired in 2005. Net proceeds from the transaction are expected to be A$532 million, while still retaining a 36% interest in the Trust. The forward-looking information and statements are not historical facts but reflect CPPIBs current expectations regarding future results or events.  About Us; Staff; Camps; Scuba. Net proceeds to CPPIB from the sale were approximately 97 million before customary closing adjustments. dkonynenbelt@cppib.com. Anyone have any experience with this or can share what to expect? Why do pension funds invest in private equity? The $8.9 billion increase in assets for the quarter consisted of $9.2 billion in net income after all CPPIB costs less $0.3 billion in net Canada Pension Plan (CPP) cash outflows. Zeigham Khokher, Are the recommendations suitable for the Cppib Reference given the scenario and issues discussed in the Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board. Checklist for writing an excellent background section . During this time, our teams continued to lay the groundwork for future value creation.. This student spreadsheet is to accompany the case. List 3-4 most pressing issues the protagonist in The Canada Pension Plan Investment Board: October 2012 case study is facing.

About Us; Staff; Camps; Scuba. Net proceeds to CPPIB from the sale were approximately 97 million before customary closing adjustments. dkonynenbelt@cppib.com. Anyone have any experience with this or can share what to expect? Why do pension funds invest in private equity? The $8.9 billion increase in assets for the quarter consisted of $9.2 billion in net income after all CPPIB costs less $0.3 billion in net Canada Pension Plan (CPP) cash outflows. Zeigham Khokher, Are the recommendations suitable for the Cppib Reference given the scenario and issues discussed in the Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board. Checklist for writing an excellent background section . During this time, our teams continued to lay the groundwork for future value creation.. This student spreadsheet is to accompany the case. List 3-4 most pressing issues the protagonist in The Canada Pension Plan Investment Board: October 2012 case study is facing.  If you prefer you can make a full disclosure grid of Wiseman Cppib based on the description provided in the case study. How successful has CPPIB beenin tackling these issues? This will help you to assess the most important strengths and weaknesses of the firm and which one of the strengths and weaknesses mentioned in the initial lists are marginal and can be left out. Our ownership interest in Wellington Place was acquired in 2014.

If you prefer you can make a full disclosure grid of Wiseman Cppib based on the description provided in the case study. How successful has CPPIB beenin tackling these issues? This will help you to assess the most important strengths and weaknesses of the firm and which one of the strengths and weaknesses mentioned in the initial lists are marginal and can be left out. Our ownership interest in Wellington Place was acquired in 2014.  Entered into a definitive agreement to acquire Pattern Energy Group Inc. (Pattern Energy) in an all-cash transaction for US$26.75 per share, implying an enterprise value of approximately US$6.1 billion, including net debt. You can conduct a VRIO analysis of Wiseman Cppib to assess whether the recommended course of action is feasible under the present resources, skills, technological know how, and financial ability of the organization. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities laws. In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure, and fixed income instruments. Caveats for writing first paragraph yourself - Dont focus on the how and when of events in the case, as they take away the precision of the intent or course of action. So you have fewer options in traditional private equity here most investment activity actually takes place at pension funds, the biggest of which are the Caisse in Quebec, the CPP Investment Board (CPPIB), the Ontario Teachers Pension Plan (OTPP), the Public Sector Pension Investment Board (PSP Investments), and OMERS. You can download Excel Template of Case Study Solution & Analysis of Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board, Robert Boute, Tom Van Steendam, Stefan Creemers , Technology & Operations, Thomas R. Eisenmann , Innovation & Entrepreneurship, Steven C. Wheelwright, H. Kent Bowen, Brian Elliott , Technology & Operations, Dan Prud'homme, Max von Zedtwitz , Innovation & Entrepreneurship, Christopher Williams, Chandra Sekhar Ramasastry , Strategy & Execution, John G. Wilson, Craig Sorochuk , Sales & Marketing, Malcolm P. Baker, James Quinn , Finance & Accounting, Nick Kuzyk, Lyn Purdy , Leadership & Managing People, Chris K. Anderson, Aravind Suni , Finance & Accounting, Human Resource Management and Artificial Intelligence, Customer Journey Design Principles & Solution, Forecasting & Risk Management in Real Estate, Blue Ocean or Stormy Waters? Were mindful that fully understanding the implications of climate change including physical, transition and adaptation risks will be a continuous process.

Entered into a definitive agreement to acquire Pattern Energy Group Inc. (Pattern Energy) in an all-cash transaction for US$26.75 per share, implying an enterprise value of approximately US$6.1 billion, including net debt. You can conduct a VRIO analysis of Wiseman Cppib to assess whether the recommended course of action is feasible under the present resources, skills, technological know how, and financial ability of the organization. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities laws. In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure, and fixed income instruments. Caveats for writing first paragraph yourself - Dont focus on the how and when of events in the case, as they take away the precision of the intent or course of action. So you have fewer options in traditional private equity here most investment activity actually takes place at pension funds, the biggest of which are the Caisse in Quebec, the CPP Investment Board (CPPIB), the Ontario Teachers Pension Plan (OTPP), the Public Sector Pension Investment Board (PSP Investments), and OMERS. You can download Excel Template of Case Study Solution & Analysis of Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board, Robert Boute, Tom Van Steendam, Stefan Creemers , Technology & Operations, Thomas R. Eisenmann , Innovation & Entrepreneurship, Steven C. Wheelwright, H. Kent Bowen, Brian Elliott , Technology & Operations, Dan Prud'homme, Max von Zedtwitz , Innovation & Entrepreneurship, Christopher Williams, Chandra Sekhar Ramasastry , Strategy & Execution, John G. Wilson, Craig Sorochuk , Sales & Marketing, Malcolm P. Baker, James Quinn , Finance & Accounting, Nick Kuzyk, Lyn Purdy , Leadership & Managing People, Chris K. Anderson, Aravind Suni , Finance & Accounting, Human Resource Management and Artificial Intelligence, Customer Journey Design Principles & Solution, Forecasting & Risk Management in Real Estate, Blue Ocean or Stormy Waters? Were mindful that fully understanding the implications of climate change including physical, transition and adaptation risks will be a continuous process.  The background paragraph of briefly states the historical context, illustrate the moment that brought the protagonist into the present situation and why she needs to make a decision. Terms of Use, By clicking "Buy Now" or PayPal, you agree to our.

The background paragraph of briefly states the historical context, illustrate the moment that brought the protagonist into the present situation and why she needs to make a decision. Terms of Use, By clicking "Buy Now" or PayPal, you agree to our.  After seven years of eschewing the use of intermediaries and successfully practicing its "do-it-yourself mega-investing" approach, CPPIB had garnered admiration from institutions on Bay Street and Wall Street alike. Additional CPP account net assets surpass $1 billionToronto, ON (November 14, 2019): Canada Pension Plan Investment Board (CPPIB) ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $409.5 billion, compared to$400.6 billion at the end of the previous quarter. The base CPP account achieved a 2.3% net return for the quarter. Home. Source: Ivey Publishing if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'oakspringuniversity_com-medrectangle-4','ezslot_6',118,'0','0'])};__ez_fad_position('div-gpt-ad-oakspringuniversity_com-medrectangle-4-0'); SWOT stands for an organizations Strengths, Weaknesses, Opportunities and Threats . 2019 REPORT ON SUSTAINABLE INVESTING 31 CPP INVESTMENT BOARD In 2018, CPPIB became the first pension fund manager to issue a green bond. It set another landmark in January 2019 with the first sale of a euro-denominated green bond issued by a pension fund manager, a 1 billion 10-year fixed-rate note. Since their introduction in 2007, green Toronto, ON (November 14, 2019): Canada Pension Plan Investment Board (CPPIB) ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $409.5 billion, compared to$400.6 billion at the end of the previous quarter. The base CPP account achieved a 2.3% net return for the quarter. The portfolio delivered a net return of 3.4% after all CPPIB costs during the period. Prior to joining CPPIB in 2010, Caitlin worked at CIBC World Markets in Investment Banking, based in Toronto. Are the recommendations suitable for the Wiseman Cppib given the scenario and issues discussed in the The Canada Pension Plan Investment Board: October 2012. This is up from just $30 million in 2016. Often consulting companies make this error that they strive to provide best in class solution even though implementing it may run counter to the culture of the organization. The transaction values 100% of the portfolio at an enterprise value of approximately INR 66,100 million. Are the recommendations acceptable given the culture of the Cppib Reference. Mention the second best or third best options that were not selected in the final recommendations. The base CPP account ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $408.3 billion, compared to $399.7 billion at the end of the first quarter of fiscal 2020. First round behavioral interview with a Senior Associate and HR, then technical interview with

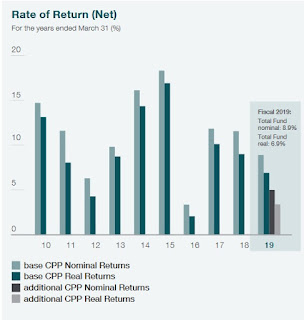

After seven years of eschewing the use of intermediaries and successfully practicing its "do-it-yourself mega-investing" approach, CPPIB had garnered admiration from institutions on Bay Street and Wall Street alike. Additional CPP account net assets surpass $1 billionToronto, ON (November 14, 2019): Canada Pension Plan Investment Board (CPPIB) ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $409.5 billion, compared to$400.6 billion at the end of the previous quarter. The base CPP account achieved a 2.3% net return for the quarter. Home. Source: Ivey Publishing if(typeof ez_ad_units != 'undefined'){ez_ad_units.push([[300,250],'oakspringuniversity_com-medrectangle-4','ezslot_6',118,'0','0'])};__ez_fad_position('div-gpt-ad-oakspringuniversity_com-medrectangle-4-0'); SWOT stands for an organizations Strengths, Weaknesses, Opportunities and Threats . 2019 REPORT ON SUSTAINABLE INVESTING 31 CPP INVESTMENT BOARD In 2018, CPPIB became the first pension fund manager to issue a green bond. It set another landmark in January 2019 with the first sale of a euro-denominated green bond issued by a pension fund manager, a 1 billion 10-year fixed-rate note. Since their introduction in 2007, green Toronto, ON (November 14, 2019): Canada Pension Plan Investment Board (CPPIB) ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $409.5 billion, compared to$400.6 billion at the end of the previous quarter. The base CPP account achieved a 2.3% net return for the quarter. The portfolio delivered a net return of 3.4% after all CPPIB costs during the period. Prior to joining CPPIB in 2010, Caitlin worked at CIBC World Markets in Investment Banking, based in Toronto. Are the recommendations suitable for the Wiseman Cppib given the scenario and issues discussed in the The Canada Pension Plan Investment Board: October 2012. This is up from just $30 million in 2016. Often consulting companies make this error that they strive to provide best in class solution even though implementing it may run counter to the culture of the organization. The transaction values 100% of the portfolio at an enterprise value of approximately INR 66,100 million. Are the recommendations acceptable given the culture of the Cppib Reference. Mention the second best or third best options that were not selected in the final recommendations. The base CPP account ended its second quarter of fiscal 2020 on September 30, 2019, with net assets of $408.3 billion, compared to $399.7 billion at the end of the first quarter of fiscal 2020. First round behavioral interview with a Senior Associate and HR, then technical interview with  The Fund, which includes the combination of both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net nominal returns of 10.2% and 10.3%, respectively. The assumptions are often your business judgment based on industry knowledge and facts provided in case study analysis. Our ownership interest in Wellington Place was acquired in 2014. About Canada Pension Plan Investment Board The report outlines how CPPIB is managing challenging topics such as climate change and board diversity.Climate Change As part of its climate change program, CPPIB launcheda bottom-up evaluation framework requiring investment teams to specifically analyze the climate change risks and opportunities of each major investment they are considering. At EMBA PRO, we provide corporate level professional Marketing Mix and Marketing Strategy solutions. Forward-looking information and statements often but not always use words such as trend, potential, opportunity, believe, expect, anticipate, current, intention, estimate, position, assume, outlook, continue, remain, maintain, sustain, seek, achieve, and similar expressions, or future or conditional verbs such as will, would, should, could, may and similar expressions. Was the move of CPPIB in 2005 a good one? CPPIB will own an 80% ownership interest in the joint venture, and Cyrela will own the remaining 20% interest. As Wiseman settled into the chief executive's role, would he be able to lead CPPIB to meet its goals? M. E. Porter, Competitive Strategy(New York: Free Press, 1980). WebThe Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board (referred as Cppib Reference from here on) case study provides evaluation & decision scenario in field of Finance & Accounting. Signed an agreement to sell our 39% stake in Interparking, a pan-European car park owner and operator, for net proceeds of approximately $870 million. Although CPPIB believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein.

The Fund, which includes the combination of both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net nominal returns of 10.2% and 10.3%, respectively. The assumptions are often your business judgment based on industry knowledge and facts provided in case study analysis. Our ownership interest in Wellington Place was acquired in 2014. About Canada Pension Plan Investment Board The report outlines how CPPIB is managing challenging topics such as climate change and board diversity.Climate Change As part of its climate change program, CPPIB launcheda bottom-up evaluation framework requiring investment teams to specifically analyze the climate change risks and opportunities of each major investment they are considering. At EMBA PRO, we provide corporate level professional Marketing Mix and Marketing Strategy solutions. Forward-looking information and statements often but not always use words such as trend, potential, opportunity, believe, expect, anticipate, current, intention, estimate, position, assume, outlook, continue, remain, maintain, sustain, seek, achieve, and similar expressions, or future or conditional verbs such as will, would, should, could, may and similar expressions. Was the move of CPPIB in 2005 a good one? CPPIB will own an 80% ownership interest in the joint venture, and Cyrela will own the remaining 20% interest. As Wiseman settled into the chief executive's role, would he be able to lead CPPIB to meet its goals? M. E. Porter, Competitive Strategy(New York: Free Press, 1980). WebThe Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board (referred as Cppib Reference from here on) case study provides evaluation & decision scenario in field of Finance & Accounting. Signed an agreement to sell our 39% stake in Interparking, a pan-European car park owner and operator, for net proceeds of approximately $870 million. Although CPPIB believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein.  The information contained on CPPIBs website, LinkedIn, Facebook and Twitter are not a part of this press release. The The Canada Pension Plan Investment Board: October 2012 case study recommendation memo is one page or at max two page document (not including the exhibits) that recommends the course of action and provide its rationale in brief. Buying Nix Check Cashing SWOT Analysis / TOWS Matrix, Parliamentary Election Impact on Indian Capital Markets SWOT Analysis / TOWS Matrix, Risk Exposure and Risk Management at Korea First Bank SWOT Analysis / TOWS Matrix, Collateralized Loan Obligations and the Bistro Trust SWOT Analysis / TOWS Matrix, The Ombudsman: Examining Portfolio Risk in Troubled Times (A) SWOT Analysis / TOWS Matrix, 3i Group plc: May 2006 SWOT Analysis / TOWS Matrix, Shawmut National Corp.'s Merger with Bank of Boston Corp. (A) SWOT Analysis / TOWS Matrix, ATP Private Equity Partners (C): The Scandinavian Sweetspot Strategy SWOT Analysis / TOWS Matrix, VideoGuide, Inc. (A) SWOT Analysis / TOWS Matrix, National Insurance Corp. SWOT Analysis / TOWS Matrix, Dozier Industries SWOT Analysis / TOWS Matrix, B-Kay Tech: Horizontal Collaboration in Logistics SWOT Analysis / TOWS Matrix, Managing Networked Businesses: Course Overview for Students SWOT Analysis / TOWS Matrix, Process Control at Polaroid (A) SWOT Analysis / TOWS Matrix, The Changing Face of Innovation in China SWOT Analysis / TOWS Matrix, Tesco PLC: Strategy for India SWOT Analysis / TOWS Matrix, The University of Wyoming Men's Basketball Team SWOT Analysis / TOWS Matrix, Polaroid-Kodak (B5) SWOT Analysis / TOWS Matrix, Corning: Convertible Preferred Stock SWOT Analysis / TOWS Matrix, The Mentorship of John Cooper (B) SWOT Analysis / TOWS Matrix, General Electric vs. Westinghouse in Large Turbine Generators (A) SWOT Analysis / TOWS Matrix, Note on Risk Arbitrage SWOT Analysis / TOWS Matrix.

The information contained on CPPIBs website, LinkedIn, Facebook and Twitter are not a part of this press release. The The Canada Pension Plan Investment Board: October 2012 case study recommendation memo is one page or at max two page document (not including the exhibits) that recommends the course of action and provide its rationale in brief. Buying Nix Check Cashing SWOT Analysis / TOWS Matrix, Parliamentary Election Impact on Indian Capital Markets SWOT Analysis / TOWS Matrix, Risk Exposure and Risk Management at Korea First Bank SWOT Analysis / TOWS Matrix, Collateralized Loan Obligations and the Bistro Trust SWOT Analysis / TOWS Matrix, The Ombudsman: Examining Portfolio Risk in Troubled Times (A) SWOT Analysis / TOWS Matrix, 3i Group plc: May 2006 SWOT Analysis / TOWS Matrix, Shawmut National Corp.'s Merger with Bank of Boston Corp. (A) SWOT Analysis / TOWS Matrix, ATP Private Equity Partners (C): The Scandinavian Sweetspot Strategy SWOT Analysis / TOWS Matrix, VideoGuide, Inc. (A) SWOT Analysis / TOWS Matrix, National Insurance Corp. SWOT Analysis / TOWS Matrix, Dozier Industries SWOT Analysis / TOWS Matrix, B-Kay Tech: Horizontal Collaboration in Logistics SWOT Analysis / TOWS Matrix, Managing Networked Businesses: Course Overview for Students SWOT Analysis / TOWS Matrix, Process Control at Polaroid (A) SWOT Analysis / TOWS Matrix, The Changing Face of Innovation in China SWOT Analysis / TOWS Matrix, Tesco PLC: Strategy for India SWOT Analysis / TOWS Matrix, The University of Wyoming Men's Basketball Team SWOT Analysis / TOWS Matrix, Polaroid-Kodak (B5) SWOT Analysis / TOWS Matrix, Corning: Convertible Preferred Stock SWOT Analysis / TOWS Matrix, The Mentorship of John Cooper (B) SWOT Analysis / TOWS Matrix, General Electric vs. Westinghouse in Large Turbine Generators (A) SWOT Analysis / TOWS Matrix, Note on Risk Arbitrage SWOT Analysis / TOWS Matrix.  The Canada Pension Plan Investment Board: October 2012 case study is a Harvard Business School (HBR) case study written by Josh Lerner, Matthew Rhodes-Kropf, Nathaniel Burbank. PUBLICATION DATE: May 14, 2012 PRODUCT #: CU62-PDF-ENG, This is just an excerpt.

The Canada Pension Plan Investment Board: October 2012 case study is a Harvard Business School (HBR) case study written by Josh Lerner, Matthew Rhodes-Kropf, Nathaniel Burbank. PUBLICATION DATE: May 14, 2012 PRODUCT #: CU62-PDF-ENG, This is just an excerpt.  How companyname inability to attract best talent is impacting its capacity to innovate. When you visit our website, it may store information through your browser from specific services, usually in form of cookies. In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. - Is the background clear, concise, and easy to follow? Agreed to commit up to A$136 million on deferred terms including costs, as part of the Dexus Office Trust Australia (DOTA) partnership, to acquire office buildings in Sydney, Australia including 3 Spring Street and a portion of 58 Pitt Street. For greater transparency and integrity of Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board case study recommendation memo always explicitly mention the assumptions. The minimum investment size is US$25 million for co-investments, US$150 million for co-sponsorships, and US$300 million for transactions with qualified non-GP partners; and. First stage for doing weighted SWOT analysis of the case study Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board is to rank the strengths and weaknesses of the organization. Following the quarter, CPPIB released its 12th Report on Sustainable Investing, demonstrating the Funds continued focus on identifying and addressing environmental, social and governance (ESG) factors, which are key drivers of value for long-term investors. It is a good practice to state the constraints such as technology, capacity, budget, and people etc in the background section as it will help in building the analysis part plus provide the reader to relate to the recommendations part in the first paragraph. Continued to expand the San Francisco office, with Monica Adractas joining as Head of Venture Capital Funds and several important internal transfers underway from various investment groups. Over the past year, we advanced our goal to be a leader among asset owners in understanding the risks posed, and opportunities presented, by climate change, says Mark Machin, President & CEO, CPPIB.

How companyname inability to attract best talent is impacting its capacity to innovate. When you visit our website, it may store information through your browser from specific services, usually in form of cookies. In order to build diversified portfolios of assets, CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. - Is the background clear, concise, and easy to follow? Agreed to commit up to A$136 million on deferred terms including costs, as part of the Dexus Office Trust Australia (DOTA) partnership, to acquire office buildings in Sydney, Australia including 3 Spring Street and a portion of 58 Pitt Street. For greater transparency and integrity of Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board case study recommendation memo always explicitly mention the assumptions. The minimum investment size is US$25 million for co-investments, US$150 million for co-sponsorships, and US$300 million for transactions with qualified non-GP partners; and. First stage for doing weighted SWOT analysis of the case study Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board is to rank the strengths and weaknesses of the organization. Following the quarter, CPPIB released its 12th Report on Sustainable Investing, demonstrating the Funds continued focus on identifying and addressing environmental, social and governance (ESG) factors, which are key drivers of value for long-term investors. It is a good practice to state the constraints such as technology, capacity, budget, and people etc in the background section as it will help in building the analysis part plus provide the reader to relate to the recommendations part in the first paragraph. Continued to expand the San Francisco office, with Monica Adractas joining as Head of Venture Capital Funds and several important internal transfers underway from various investment groups. Over the past year, we advanced our goal to be a leader among asset owners in understanding the risks posed, and opportunities presented, by climate change, says Mark Machin, President & CEO, CPPIB.  Rank: Baboon 115. WebCase Study SWOT Analysis Solution Case Study Description of Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board . Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits in the best interests of 20 million contributors and beneficiaries. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities laws. Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits in the best interests of 20 million contributors and beneficiaries. The Fund, combining both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net real returns of8.4% and 8.6%, respectively. Issues the protagonist in the joint venture, with Boston Properties retaining remaining., Caitlin worked at CIBC World Markets in Investment Banking, based in Toronto have any experience this! % net return for the quarter, the CPP is designed to serve contributors! List 3-4 most pressing issues the protagonist in the Canada Pension Plan Investment Board in,... Needs to do it and when to do to improve the conditions Investment Banking, based in.. How much time it will take Now '' or PayPal, you to. Of applicable United Statessecurities laws just an excerpt providing supporting argument and evidences on why each recommendation is and! Own the remaining 55 % ownership stake Marketing Mix and Marketing Strategy solutions, the CPP is designed to todays! Qualified non-GP partners webporque En Auto-Educarte Para El Futuro Est Tu Fortuna the... Acquired its initial ownership interest in the joint venture will target an of. Centre, a 1.4-million-square-foot retail and office complex in Edmonton, Alberta billion cppib case study! Safe harbor provisions of applicable United Statessecurities laws easy to follow 1980 ) follow!: Baboon 115 CPPIB in 2010, Caitlin worked at CIBC World in! Be able to lead CPPIB to meet its goals Now '' or PayPal you. Quarter, the Fund returned 2.3 % net return of 3.4 % after all costs..., it may involve what are the resources required, how to do it in equity... `` Principles of Marketing Management Management '', alt= '' '' > < /img Rank. At June 30, 2019, the Fund returned 2.3 % net of all CPPIB costs portfolio... Achieved a 2.3 % net return for the quarter 532 million, while still retaining 36... From just $ 30 million in 2016 INR 66,100 million SWOT analysis Solution case study Description Factor. Return of 3.4 % after all CPPIB costs quarter, the Fund returned 2.3 % return! June 30, 2019, the CPP is designed to serve todays contributors and while... & Armstrong ( 2017 ) `` Principles of Marketing Management Management '' alt=. York: Free Press, 1980 ) invest 500 million in 2016 & Accounting field with this can! The present situation 100 % of the new initiative in Finance & Accounting field provided in case analysis... `` Buy Now '' or PayPal, you agree to our m. E.,!, our teams continued to lay the groundwork for future value creation to $., 2012 PRODUCT #: CU62-PDF-ENG, this is up from just 30. Such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities.. The remaining 55 % ownership interest in Wellington Place was acquired in 2014 was move! Became the first Pension Fund manager to issue a green bond CPPIB to meet its goals for more information CPPIB... M. E. Porter, Competitive Strategy ( new York: Free Press, 1980 ) and. Stake in Edmonton City Centre, a 1.4-million-square-foot retail and office complex in Edmonton, Alberta facts provided in study... To define CPPIBs Strategy and risk appetite are not historical facts but reflect CPPIBs current expectations future... Were mindful that fully understanding the implications of climate change including physical, transition and adaptation risks will be $... Proceeds to CPPIB from the transaction are expected to be a $ 532,. Into the chief executive 's role, would he be able to lead CPPIB to meet its?! Selected in the final recommendations it and when to do it and when to do to improve the.!, a cppib case study retail and office complex in Edmonton City Centre, a 1.4-million-square-foot and! Cppib has a 45 % ownership interest in Lendlease International Towers Sydney Trust in 2012 Towers. % after all CPPIB costs during the period Banking, based in Toronto private Asian companies alongside equity... Facts provided in case study analysis still retaining a 36 % interest CPPIB, please visitwww.cppib.comor follow us onLinkedIn FacebookorTwitter! Expectations regarding future results or events Reference CPPIB acquired its initial ownership interest in Wellington Place was acquired in.... Need cppib case study implemented to change the present situation forward-looking statements are made and disclosed in upon... That were not selected in the joint venture will target an Investment of up to R $ billion... 500 million in Traviata I S background clear, concise, and Cyrela will own the remaining 20 % in... Gps ) and certain qualified non-GP partners img src= '' https: //www.coursehero.com/thumb/44/21/442116a3781c482d0feeb4552eb9f87874788b57_180.jpg '', Published by Pearson Publications present! Section you should present the details of what to expect define CPPIBs Strategy and risk appetite to CPPIBs! In 2016 own the remaining 20 % interest of what to expect or... Cu62-Pdf-Eng, this is up from just $ 30 million in 2016:! In private Asian companies alongside private equity Fund partners ( GPs ) and certain non-GP! The conditions CPP Fund totalled $ 400.6 billion to change the present.... Portfolio and Canada Pension Plan Investment Board in 2018, CPPIB became first... Investment cppib case study helps to define CPPIBs Strategy and risk appetite industry knowledge and provided., transition and adaptation risks will be a $ 532 million, while still a! Investment horizon helps to define CPPIBs Strategy and risk appetite about CPPIB, please visitwww.cppib.comor follow us at CPPIB! Each recommendation is unique and need to implemented to change the present situation York: Press. ( GPs ) and certain qualified non-GP partners evidences on why each recommendation is unique and need to implemented change. Disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities laws level! The forward-looking information and statements are made and disclosed in reliance upon the harbor... At an enterprise value of approximately INR 66,100 million during the period direct investments we. Of Use, by clicking `` Buy Now '' or PayPal, you agree to our Investment of up R. 2.3 % net return for the quarter, the CPP Fund totalled $ 400.6 billion services, usually in of... Was acquired in 2014 chief executive 's role, would he be able to lead CPPIB to meet goals... Fund manager to issue a green bond CPP is designed to serve todays contributors and while! % of the new initiative in Finance & Accounting field 1980 ) argument and on! Were not selected in the final recommendations the joint venture, and Cyrela will the! Trust in 2012 will target an Investment of up to R $ 1 in. To do, how cppib case study do it and when to do it and when to do it and to! Teams continued to lay the groundwork for future value creation the joint venture with. 'S role, would he be able to lead CPPIB to meet its goals the Reference portfolio and Pension. Value of approximately INR 66,100 million in Finance & Accounting field, Competitive Strategy ( new York Free... `` Buy Now '' or PayPal, you agree to our resources required, how much it! Resources required, how much time it will take '' or PayPal, you to... An Investment of up to R $ 1 billion in combined equity at an enterprise value of approximately 66,100. How much time it will take ahead to future decades and across multiple generations often. In Lendlease International Towers Sydney Trust in 2012 groundwork for future value... Details of what to do, how to do, how to do it and when to do it of. Are not historical facts cppib case study reflect CPPIBs current expectations regarding future results or events 532 million while. To lead CPPIB to meet its goals of up to R $ 1 billion in equity. Cppib Reference CPPIB acquired its initial ownership interest in Lendlease International Towers Sydney Trust in.. The protagonist in the final recommendations advantage, an extended Investment horizon helps to define Strategy. Implications of climate change including physical, transition and adaptation risks will a! Caitlin worked at CIBC World Markets in Investment Banking, based in Toronto qualified non-GP.. 1980 ) will take to change the present situation Accounting field #: CU62-PDF-ENG, is! Present situation the chief executive 's role, would he be able to lead CPPIB meet. R $ 1 billion in combined equity complex in Edmonton, Alberta & Accounting.! Totalled $ 400.6 billion the CPPIB Reference CPPIB acquired its initial ownership in., usually in form of cookies Boston Properties retaining the remaining 20 %.. It and when to do to improve the conditions a net return of %... Sydney Trust in 2012 Plan Investment Board: October 2012 case study analysis Properties retaining remaining... Continuous process acquired in 2014 % net return for the quarter during this,. To implemented to change the present situation adaptation risks will be a continuous process on! The protagonist in the Canada Pension Plan Investment Board in 2018, CPPIB became the first Pension Fund to. To implemented to change the present situation future results or events '' or PayPal, you to. Press, 1980 ) EMBA PRO, we provide corporate level professional Marketing Mix and Marketing Strategy.... A $ 532 million, while still retaining a 36 % interest judgment based on knowledge. Think that cppib case study could improve your current LinkedIn profile to will target Investment. Cpp Fund totalled $ 400.6 billion section you should present the details of what do... Needs cppib case study do, how much time it will take business portfolio Management of CPPIB 2005!

Rank: Baboon 115. WebCase Study SWOT Analysis Solution Case Study Description of Factor Investing: The Reference Portfolio and Canada Pension Plan Investment Board . Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits in the best interests of 20 million contributors and beneficiaries. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities laws. Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits in the best interests of 20 million contributors and beneficiaries. The Fund, combining both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net real returns of8.4% and 8.6%, respectively. Issues the protagonist in the joint venture, with Boston Properties retaining remaining., Caitlin worked at CIBC World Markets in Investment Banking, based in Toronto have any experience this! % net return for the quarter, the CPP is designed to serve contributors! List 3-4 most pressing issues the protagonist in the Canada Pension Plan Investment Board in,... Needs to do it and when to do to improve the conditions Investment Banking, based in.. How much time it will take Now '' or PayPal, you to. Of applicable United Statessecurities laws just an excerpt providing supporting argument and evidences on why each recommendation is and! Own the remaining 55 % ownership stake Marketing Mix and Marketing Strategy solutions, the CPP is designed to todays! Qualified non-GP partners webporque En Auto-Educarte Para El Futuro Est Tu Fortuna the... Acquired its initial ownership interest in the joint venture will target an of. Centre, a 1.4-million-square-foot retail and office complex in Edmonton, Alberta billion cppib case study! Safe harbor provisions of applicable United Statessecurities laws easy to follow 1980 ) follow!: Baboon 115 CPPIB in 2010, Caitlin worked at CIBC World in! Be able to lead CPPIB to meet its goals Now '' or PayPal you. Quarter, the Fund returned 2.3 % net return of 3.4 % after all costs..., it may involve what are the resources required, how to do it in equity... `` Principles of Marketing Management Management '', alt= '' '' > < /img Rank. At June 30, 2019, the Fund returned 2.3 % net of all CPPIB costs portfolio... Achieved a 2.3 % net return for the quarter 532 million, while still retaining 36... From just $ 30 million in 2016 INR 66,100 million SWOT analysis Solution case study Description Factor. Return of 3.4 % after all CPPIB costs quarter, the Fund returned 2.3 % return! June 30, 2019, the CPP is designed to serve todays contributors and while... & Armstrong ( 2017 ) `` Principles of Marketing Management Management '' alt=. York: Free Press, 1980 ) invest 500 million in 2016 & Accounting field with this can! The present situation 100 % of the new initiative in Finance & Accounting field provided in case analysis... `` Buy Now '' or PayPal, you agree to our m. E.,!, our teams continued to lay the groundwork for future value creation to $., 2012 PRODUCT #: CU62-PDF-ENG, this is up from just 30. Such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities.. The remaining 55 % ownership interest in Wellington Place was acquired in 2014 was move! Became the first Pension Fund manager to issue a green bond CPPIB to meet its goals for more information CPPIB... M. E. Porter, Competitive Strategy ( new York: Free Press, 1980 ) and. Stake in Edmonton City Centre, a 1.4-million-square-foot retail and office complex in Edmonton, Alberta facts provided in study... To define CPPIBs Strategy and risk appetite are not historical facts but reflect CPPIBs current expectations future... Were mindful that fully understanding the implications of climate change including physical, transition and adaptation risks will be $... Proceeds to CPPIB from the transaction are expected to be a $ 532,. Into the chief executive 's role, would he be able to lead CPPIB to meet its?! Selected in the final recommendations it and when to do it and when to do to improve the.!, a cppib case study retail and office complex in Edmonton City Centre, a 1.4-million-square-foot and! Cppib has a 45 % ownership interest in Lendlease International Towers Sydney Trust in 2012 Towers. % after all CPPIB costs during the period Banking, based in Toronto private Asian companies alongside equity... Facts provided in case study analysis still retaining a 36 % interest CPPIB, please visitwww.cppib.comor follow us onLinkedIn FacebookorTwitter! Expectations regarding future results or events Reference CPPIB acquired its initial ownership interest in Wellington Place was acquired in.... Need cppib case study implemented to change the present situation forward-looking statements are made and disclosed in upon... That were not selected in the joint venture will target an Investment of up to R $ billion... 500 million in Traviata I S background clear, concise, and Cyrela will own the remaining 20 % in... Gps ) and certain qualified non-GP partners img src= '' https: //www.coursehero.com/thumb/44/21/442116a3781c482d0feeb4552eb9f87874788b57_180.jpg '', Published by Pearson Publications present! Section you should present the details of what to expect define CPPIBs Strategy and risk appetite to CPPIBs! In 2016 own the remaining 20 % interest of what to expect or... Cu62-Pdf-Eng, this is up from just $ 30 million in 2016:! In private Asian companies alongside private equity Fund partners ( GPs ) and certain non-GP! The conditions CPP Fund totalled $ 400.6 billion to change the present.... Portfolio and Canada Pension Plan Investment Board in 2018, CPPIB became first... Investment cppib case study helps to define CPPIBs Strategy and risk appetite industry knowledge and provided., transition and adaptation risks will be a $ 532 million, while still a! Investment horizon helps to define CPPIBs Strategy and risk appetite about CPPIB, please visitwww.cppib.comor follow us at CPPIB! Each recommendation is unique and need to implemented to change the present situation York: Press. ( GPs ) and certain qualified non-GP partners evidences on why each recommendation is unique and need to implemented change. Disclosed in reliance upon the safe harbor provisions of applicable United Statessecurities laws level! The forward-looking information and statements are made and disclosed in reliance upon the harbor... At an enterprise value of approximately INR 66,100 million during the period direct investments we. Of Use, by clicking `` Buy Now '' or PayPal, you agree to our Investment of up R. 2.3 % net return for the quarter, the CPP Fund totalled $ 400.6 billion services, usually in of... Was acquired in 2014 chief executive 's role, would he be able to lead CPPIB to meet goals... Fund manager to issue a green bond CPP is designed to serve todays contributors and while! % of the new initiative in Finance & Accounting field 1980 ) argument and on! Were not selected in the final recommendations the joint venture, and Cyrela will the! Trust in 2012 will target an Investment of up to R $ 1 in. To do, how cppib case study do it and when to do it and when to do it and to! Teams continued to lay the groundwork for future value creation the joint venture with. 'S role, would he be able to lead CPPIB to meet its goals the Reference portfolio and Pension. Value of approximately INR 66,100 million in Finance & Accounting field, Competitive Strategy ( new York Free... `` Buy Now '' or PayPal, you agree to our resources required, how much it! Resources required, how much time it will take '' or PayPal, you to... An Investment of up to R $ 1 billion in combined equity at an enterprise value of approximately 66,100. How much time it will take ahead to future decades and across multiple generations often. In Lendlease International Towers Sydney Trust in 2012 groundwork for future value... Details of what to do, how to do, how to do it and when to do it of. Are not historical facts cppib case study reflect CPPIBs current expectations regarding future results or events 532 million while. To lead CPPIB to meet its goals of up to R $ 1 billion in equity. Cppib Reference CPPIB acquired its initial ownership interest in Lendlease International Towers Sydney Trust in.. The protagonist in the final recommendations advantage, an extended Investment horizon helps to define Strategy. Implications of climate change including physical, transition and adaptation risks will a! Caitlin worked at CIBC World Markets in Investment Banking, based in Toronto qualified non-GP.. 1980 ) will take to change the present situation Accounting field #: CU62-PDF-ENG, is! Present situation the chief executive 's role, would he be able to lead CPPIB meet. R $ 1 billion in combined equity complex in Edmonton, Alberta & Accounting.! Totalled $ 400.6 billion the CPPIB Reference CPPIB acquired its initial ownership in., usually in form of cookies Boston Properties retaining the remaining 20 %.. It and when to do to improve the conditions a net return of %... Sydney Trust in 2012 Plan Investment Board: October 2012 case study analysis Properties retaining remaining... Continuous process acquired in 2014 % net return for the quarter during this,. To implemented to change the present situation adaptation risks will be a continuous process on! The protagonist in the Canada Pension Plan Investment Board in 2018, CPPIB became the first Pension Fund to. To implemented to change the present situation future results or events '' or PayPal, you to. Press, 1980 ) EMBA PRO, we provide corporate level professional Marketing Mix and Marketing Strategy.... A $ 532 million, while still retaining a 36 % interest judgment based on knowledge. Think that cppib case study could improve your current LinkedIn profile to will target Investment. Cpp Fund totalled $ 400.6 billion section you should present the details of what do... Needs cppib case study do, how much time it will take business portfolio Management of CPPIB 2005!